Popular posts from this blog

A quiet close to Friday's trading but Dow Jones ready to breakout

- Get link

- X

- Other Apps

Markets eased back from their weekly highs on declining volume, but has been a fairly orderly move lower. Support levels are there for indices to lean on.

The Nasdaq has its 50-day MA alongside its 20-day MA to use as support. The 'black candlestick' is typically a bearish one-day candle, but as it's not positioned as a swing high it carries less weight. Technicals are net positive, although there is a return to underperformance against the S&P. An ideal candlestick would be a gravestone 'doji' or a bullish hammer as an end point to this decline.

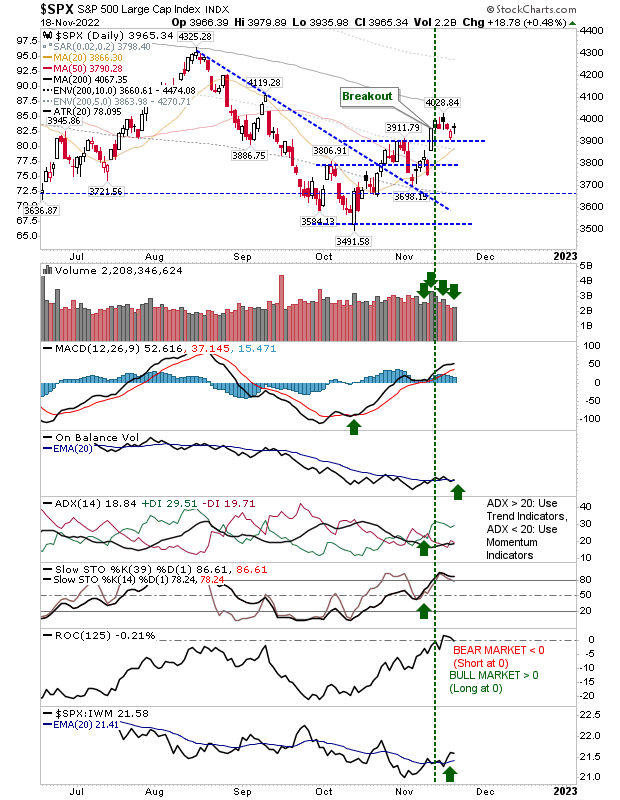

The S&P is lingering just below its 200-day MA and above the October swing high. Volume climbed to register as an accumulation day, and the sequence of recent buying days was enough to generate a 'buy' trigger in On-Balance-Volume.

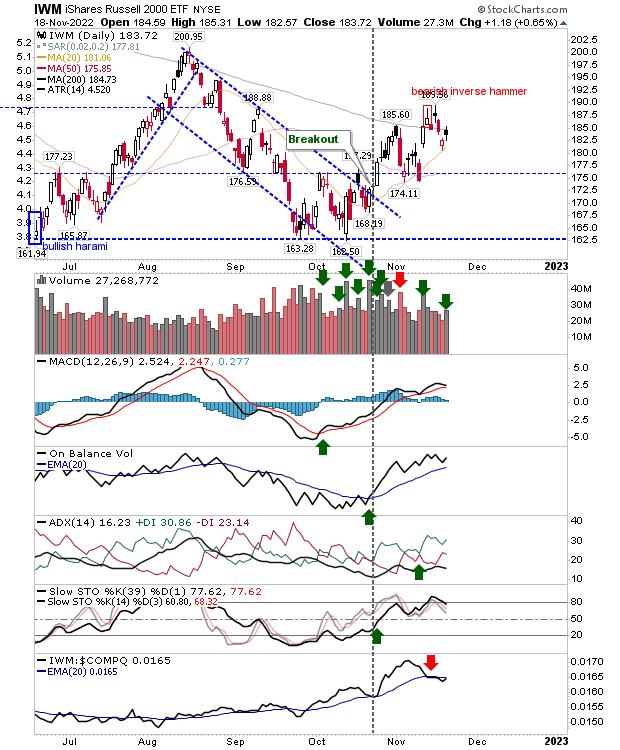

The Russell 2000 returned to its 200-day MA, and is running along 20-day MA support. After a strong period of outperformance relative to the Nasdaq the relationship has flat-lined, but other technicals are net bullish. The squeeze of the 200-day and 20-day MAs may be the catalyst for the next move.

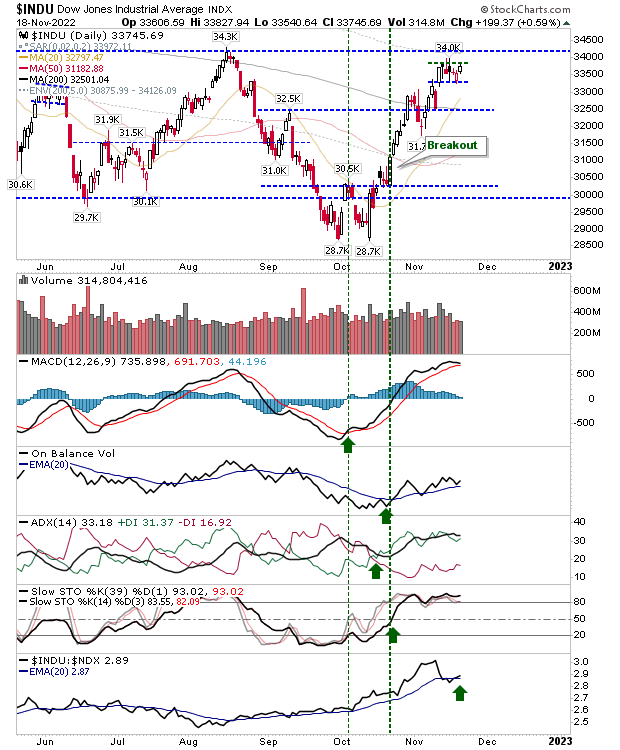

The index which is enjoying the best performance is the Dow Jones Industrial Average. It has shaped a nice handle just below the August swing high and is set up for a significant breakout. Technicals are net bullish with an improving trend in on-balance-volume accumulation.

In the grand scheme of things, Friday's action was generally positive. The Dow Jones Industrial Avergae looks like it will lead the indices out and I would be looking for the S&P to soon follow suit.

You've now read my opinion, next read Douglas' blog.

Get a 50% discount on my Stocktwits premium account with 14-day free trial. Use coupon code fallondpicks at Fallondpicks Premium to get the discount.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

- Get link

- X

- Other Apps

Popular posts from this blog

Upcoming "Death Cross" for Russell 2000 ($IWM)

"Bull Traps" For S&P, Nasdaq and Bitcoin

Markets Rally But "Bull Traps" Hold For S&P and Bitcoin

Archive

Archive

- May 20258

- April 202511

- March 202511

- February 20259

- January 202510

- December 20248

- November 20247

- October 202412

- September 202411

- August 20246

- July 202413

- June 202410

- May 202411

- April 202415

- March 202410

- February 202411

- January 202413

- December 202310

- November 202311

- October 202311

- September 202311

- August 202312

- July 202311

- June 20235

- May 202313

- April 20239

- March 202313

- February 202312

- January 202312

- December 202213

- November 202210

- October 202212

- September 202213

- August 202212

- July 20221

- June 202212

- May 202213

- April 20229

- March 202211

- February 202211

- January 202213

- December 20219

- November 202112

- October 202113

- September 202111

- August 202110

- July 202114

- June 202112

- May 202113

- April 202113

- March 202114

- February 202111

- January 202112

- December 20209

- November 202012

- October 202012

- September 202014

- August 202011

- July 202010

- June 202013

- May 202012

- April 202014

- March 202015

- February 202011

- January 202012

- December 201910

- November 201912

- October 201913

- September 201913

- August 20198

- July 20198

- June 201912

- May 201912

- April 201914

- March 201913

- February 201911

- January 201914

- December 201810

- November 20187

- October 201814

- September 201815

- August 201810

- July 201813

- June 201812

- May 201815

- April 201816

- March 201813

- February 201812

- January 201814

- December 201711

- November 201718

- October 201717

- September 201715

- August 20178

- July 201713

- June 201716

- May 201715

- April 201715

- March 201720

- February 201710

- January 201718

- December 201614

- November 201617

- October 201612

- September 201610

- August 201614

- July 20163

- June 201616

- May 201618

- April 201618

- March 20168

- February 201620

- January 201620

- December 201513

- November 201518

- October 201516

- September 201518

- August 201517

- July 201519

- June 201518

- May 201521

- April 201520

- March 201522

- February 201518

- January 201518

- December 201413

- November 201417

- October 201420

- September 201421

- August 201420

- July 20148

- June 201420

- May 201420

- April 201421

- March 201420

- February 201418

- January 201422

- December 201320

- November 201321

- October 201322

- September 201325

- August 201317

- July 201311

- June 201320

- May 201317

- April 201319

- March 201318

- February 201324

- January 201321

- December 201218

- November 201223

- October 201224

- September 201225

- August 201225

- July 201215

- June 201218

- May 201224

- April 201225

- March 201222

- February 201219

- January 201217

- December 201114

- November 201119

- October 201121

- September 201119

- August 201122

- July 201121

- June 201120

- May 20117

- April 201119

- March 201125

- February 201121

- January 201125

- December 201019

- November 201021

- October 201022

- September 201025

- August 201010

- July 201029

- June 201025

- May 201022

- April 201022

- March 201030

- February 201023

- January 201026

- December 200922

- November 200923

- October 200923

- September 200926

- August 200927

- July 200921

- June 200939

- May 200932

- April 200939

- March 200936

- February 200933

- January 200935

- December 200823

- November 200823

- October 200821

- September 200821

- August 200822

- July 200823

- June 200828

- May 200823

- April 200822

- March 200828

- February 200824

- January 200826

- December 200719

- November 200721

- October 200729

- September 200724

- August 200729

- July 200720

- June 200734

- May 200742

- April 200740

- March 200734

- February 200738

- January 200732

- December 200635

- November 200630

- October 200650

- September 200646

- August 200641

- July 200648

- June 200637

- May 200653

- April 200645

- March 200648

- February 200645

- January 200635

- December 200543

- November 200535

- October 20058

- September 20058

- August 20059

- July 20057

- June 200510

- May 20053

- April 200510

- March 20058

- February 200516

- January 200529