A quiet close to Friday's trading but Dow Jones ready to breakout

Markets eased back from their weekly highs on declining volume, but has been a fairly orderly move lower. Support levels are there for indices to lean on.

The Nasdaq has its 50-day MA alongside its 20-day MA to use as support. The 'black candlestick' is typically a bearish one-day candle, but as it's not positioned as a swing high it carries less weight. Technicals are net positive, although there is a return to underperformance against the S&P. An ideal candlestick would be a gravestone 'doji' or a bullish hammer as an end point to this decline.

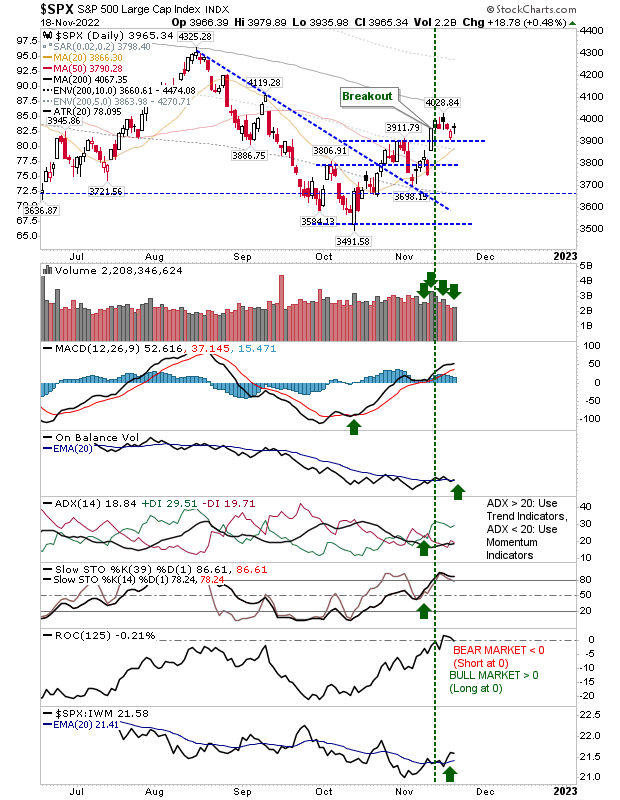

The S&P is lingering just below its 200-day MA and above the October swing high. Volume climbed to register as an accumulation day, and the sequence of recent buying days was enough to generate a 'buy' trigger in On-Balance-Volume.

The Russell 2000 returned to its 200-day MA, and is running along 20-day MA support. After a strong period of outperformance relative to the Nasdaq the relationship has flat-lined, but other technicals are net bullish. The squeeze of the 200-day and 20-day MAs may be the catalyst for the next move.

The index which is enjoying the best performance is the Dow Jones Industrial Average. It has shaped a nice handle just below the August swing high and is set up for a significant breakout. Technicals are net bullish with an improving trend in on-balance-volume accumulation.

In the grand scheme of things, Friday's action was generally positive. The Dow Jones Industrial Avergae looks like it will lead the indices out and I would be looking for the S&P to soon follow suit.

You've now read my opinion, next read Douglas' blog.

Get a 50% discount on my Stocktwits premium account with 14-day free trial. Use coupon code fallondpicks at Fallondpicks Premium to get the discount.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.