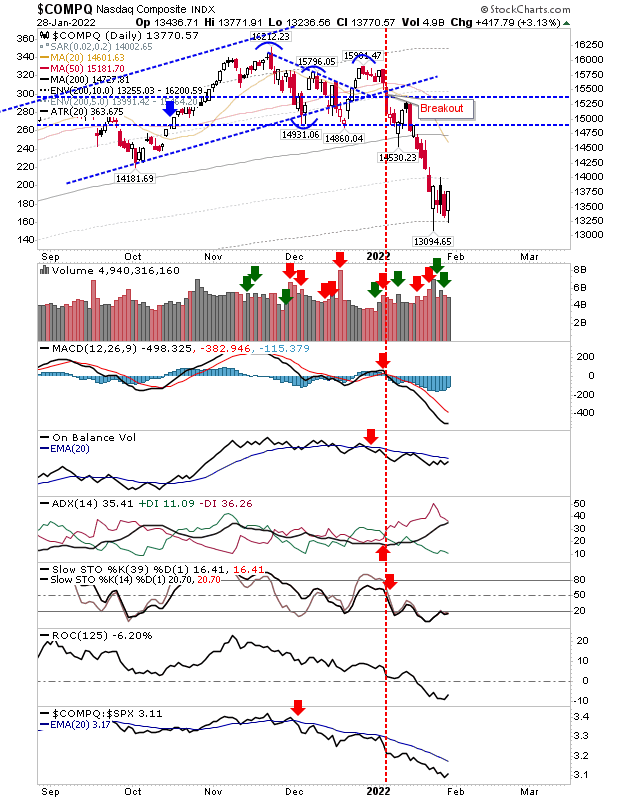

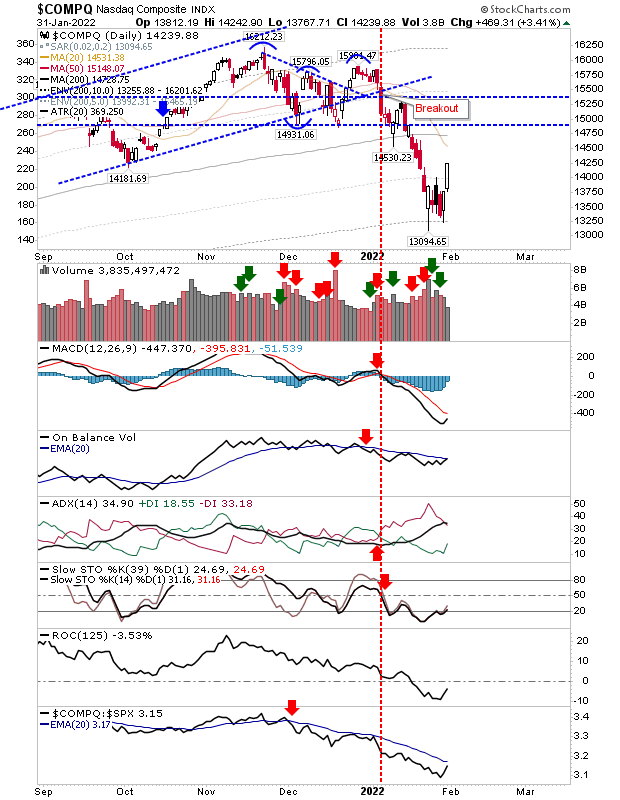

And so it begins, markets initiate a rally

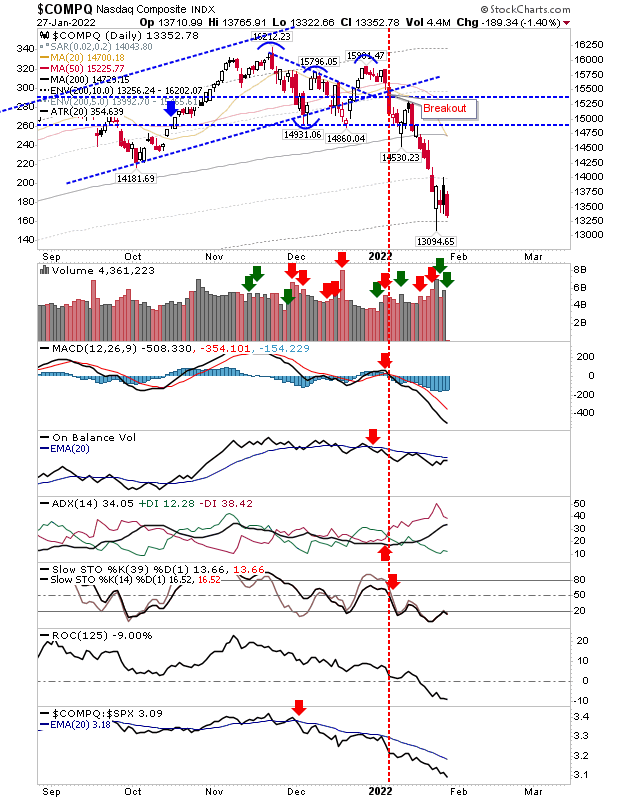

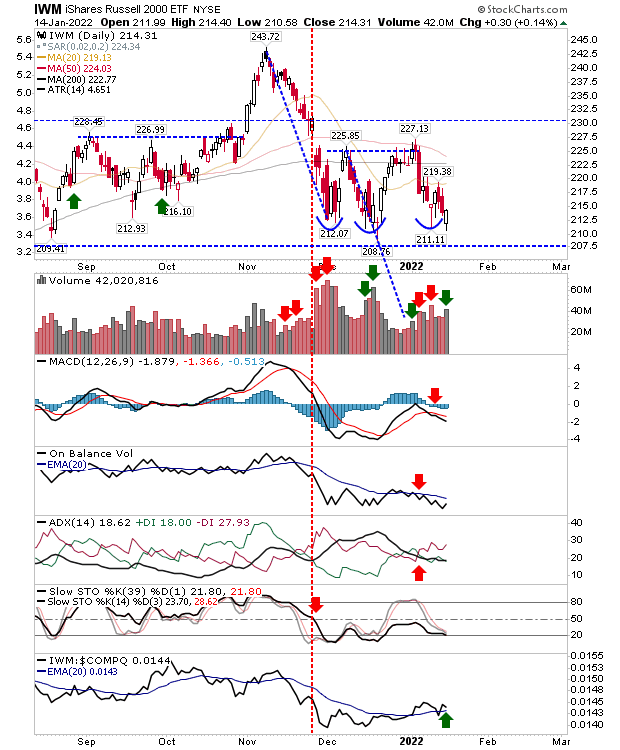

Buyers stewed over the weekend and started Monday with a period of buying across lead inside. Buying volume was down on yesterday's (and recent buying) and given the Nasdaq gained over 3% it was a little disappointing not to see volume match the large percentage gain, although things were a little better for the S&P. For the Nasdaq, there was no fresh 'buy' signals, although On-Balance-Volume is on the verge of a new trigger.