Solid defense Friday helped deflect Meta losses

Trading volume wasn't that high on Friday, but end-of-week buying helped prevent an acceleration of losses (and the fear) generated by Meta's loss in ad revenue.

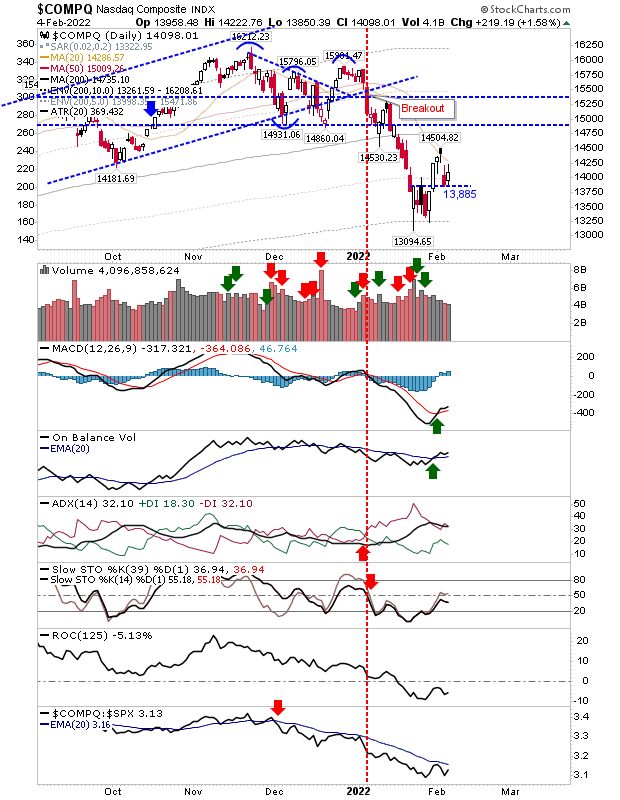

The January swing lows is looking more solid in the Nasdaq. There is a bit of a mini-support level around 13,885 which we will want to see hold on an end-of-day close basis (intraday violations are okay). We still have the MACD trigger and On-Balance-Volume 'buy'.

The S&P was able to regain 200-day MA support as part of its move from its swing low. This is now the support level which needs to hold if it's to challenge the overhead supply generated by November-December training.

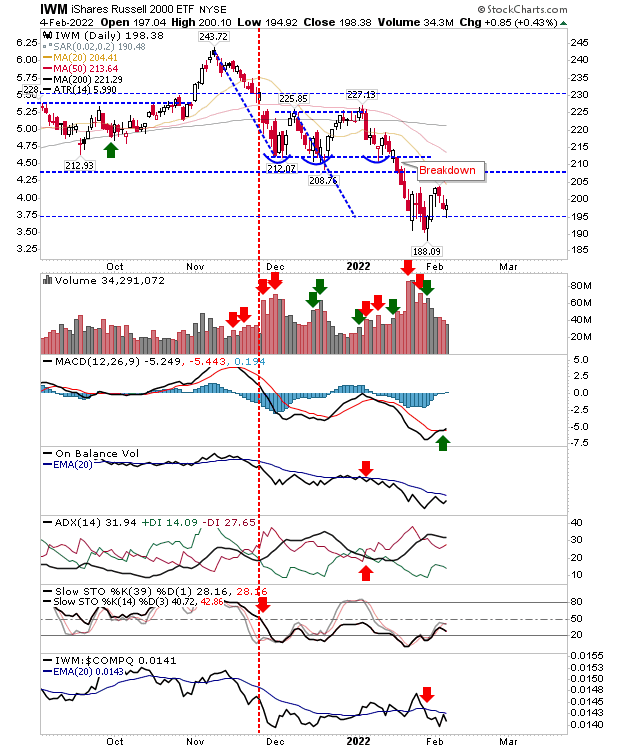

The Russell 2000 is back at its measured move support of $195 ($IWM). This stability is backed by a new MACD trigger 'buy'.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.