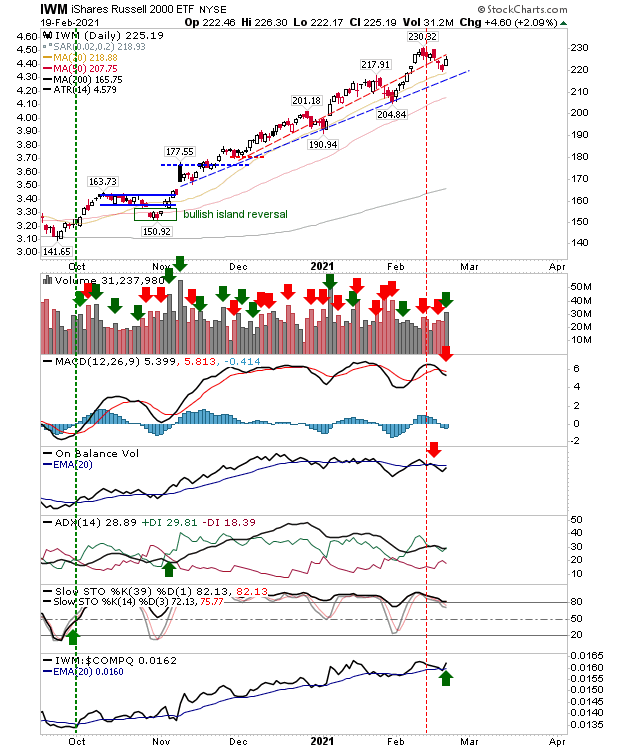

Selling Intensifies

Looks like Gamestock Part II has put a scare in the market! While this stock starts another wild ride, the broader market took a step back. Today's move carries more weight because it marked the first wide intraday day in a while, and was the first real day of selling experienced since September. For the Nasdaq, this amounted to a support break and a close below its 50-day MA. Volume selling was lighter, but perhaps shareholders aren't as worried as they probably should be...