Nasdaq and Russell 2000 Looking at 50-day MA Support

Tech and Small Caps are starting to slip from their summer advances. This may be a simple change in pace but longs for these indices will be looking to 50-day MAs to attract buyers; if these are swept it will leave support lacking until July swing lows and/or 200-day MAs.

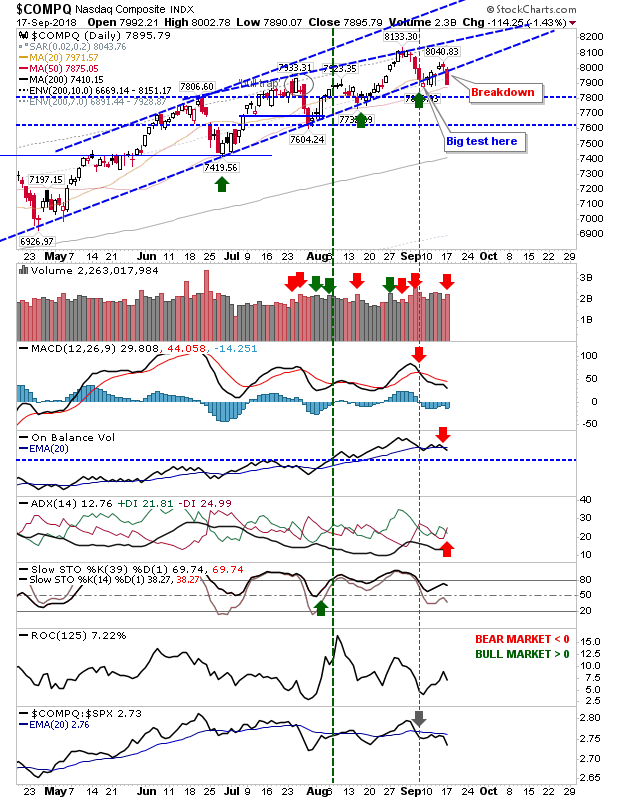

The Nasdaq fell outside of its rising channel after three prior successes. Volume climbed to register as distribution.

The Russell 2000 experienced a sequence of non-commital days which looks to have now resolved itself to the downside as 1,705 support breached. It's down to the 50-day MA to bring buyers back but if this fails then bulls are looking to swing lows, then the 200-day MA. However, prices will be trading inside a consolidation which will make trend setting more difficult to establish. I have redrawn a new (slower) channel which is also an alternative play.

The S&P also lost some ground but managed to hold onto faster channel support. There wasn't a big loss but it stands to lose momentum if weakness in Tech and Small Caps continue. The index is outperforming its peers but only because it's not selling off as quickly.

The Semiconductor Index is back pushing towards the September (and August) 'bear trap'. The consolidation triangle is struggling as support looks more vulnerable than resistance.

For tomorrow, track Tech (and Semiconductors) and Small Caps. Bulls and bears have been fighting it out since Spring but it looks like bears are gaining an edge. Taking profits or selling covered calls looks prudent.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

Dr. Declan Fallon is a blogger who trades for education on eToro and can be copied for free. Investments are held in a pension fund as buy-and-hold.

.

The Nasdaq fell outside of its rising channel after three prior successes. Volume climbed to register as distribution.

The Russell 2000 experienced a sequence of non-commital days which looks to have now resolved itself to the downside as 1,705 support breached. It's down to the 50-day MA to bring buyers back but if this fails then bulls are looking to swing lows, then the 200-day MA. However, prices will be trading inside a consolidation which will make trend setting more difficult to establish. I have redrawn a new (slower) channel which is also an alternative play.

The S&P also lost some ground but managed to hold onto faster channel support. There wasn't a big loss but it stands to lose momentum if weakness in Tech and Small Caps continue. The index is outperforming its peers but only because it's not selling off as quickly.

The Semiconductor Index is back pushing towards the September (and August) 'bear trap'. The consolidation triangle is struggling as support looks more vulnerable than resistance.

For tomorrow, track Tech (and Semiconductors) and Small Caps. Bulls and bears have been fighting it out since Spring but it looks like bears are gaining an edge. Taking profits or selling covered calls looks prudent.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

.