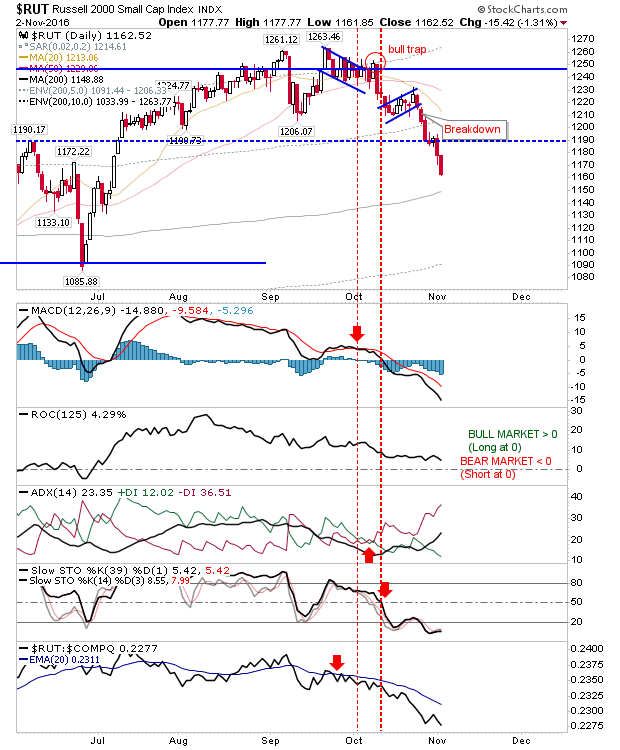

Yesterday's selling continued with Small Caps again taking the bulk of the heat.

The Russell 2000 is fast approaching its 200-day MA which should be a buying opportunity. An overshoot of this moving average in June lead to a 3-month rally, can lightning strike again? Technicals are already oversold, so there is little guidance on offer here.

The S&P is also getting close to its 200-day MA but the index hasn't experienced the rout which the Russell 2000 has endured. Relative performance has increased despite the selling which will continue to attract risk-averse money. With the election coming to an end next week markets are positioning themselves for the result. Given what's come before, a 'buy the news' rally would appear the most likely. Obama's election generated a short-term sell off in 2012, but this ultimately marked a significant trading low. Shorts should be looking to take profits.

The Nasdaq finished the day at 5,100 support. It was the only index to register a distribution day, and the only index to finish at a support level. Those looking to trade pre-market may find an opportune long position.

Tomorrow is a chance to start looking at a short profit-taking switch to a long position. Watch for an intraday spike low driven by an acceleration lower and an equally fast recovery. The Nasdaq has the best set up for longs, but a spike low to 200-day MAs for the Russell 2000 and S&P would also be attractive as a place for GTC 'buy' orders. Should the latter fail, and prices continue to head lower, then the next cross above the 200-day MA would be the 'buy' trigger.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for

ChartDNA.com, and Product Development Manager for

FirstDerivatives.com. I also trade on

eToro and can be copied for free.