Sellers Try Again

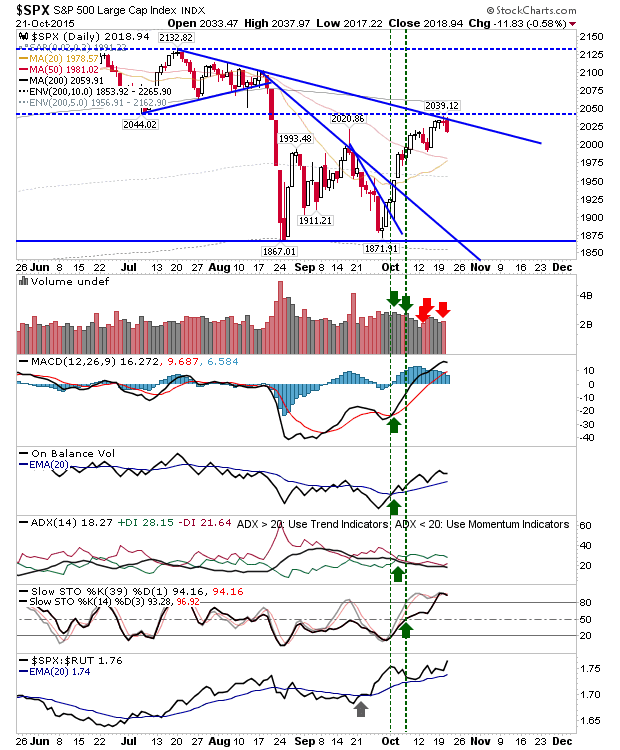

Today's selling looked much worse on an intraday chart than it probably created in reality. The profit taking did rank as distribution; distribution which kicked in at resistance for the likes of the S&P, but didn't do enough damage to threaten the breakouts in the Tech indices. While there may be some follow through down in the coming days, be ready for bulls to bid prices back. Remember, we are entering a seasonally bullish period.

The S&P has offered the picture perfect short play for those who took advantage of the tag of resistance. Technicals were little changed after today and hold with a bullish outlook.

The Nasdaq retreated back to breakout support from the declining trendline. As with the S&P, technicals are bullish. If bulls are looking for a quick recovery tomorrow, then this is the index to watch.

The Russell 2000 took the biggest hit. No surprise given its relative position as the weakest of the lead indices. Longer term bulls need to keep an eye on this given its importance as a leader in secular moves. Sellers and shorts will pounce on this, so it's important October lows hold if this isn't going to fuel doubt in other indices.

Tomorrow, bulls should watch tech indices for strength, and the S&P for weakness.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P has offered the picture perfect short play for those who took advantage of the tag of resistance. Technicals were little changed after today and hold with a bullish outlook.

The Nasdaq retreated back to breakout support from the declining trendline. As with the S&P, technicals are bullish. If bulls are looking for a quick recovery tomorrow, then this is the index to watch.

The Russell 2000 took the biggest hit. No surprise given its relative position as the weakest of the lead indices. Longer term bulls need to keep an eye on this given its importance as a leader in secular moves. Sellers and shorts will pounce on this, so it's important October lows hold if this isn't going to fuel doubt in other indices.

Tomorrow, bulls should watch tech indices for strength, and the S&P for weakness.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!