Minor Losses

Small gains yesterday, small losses today. The tone of the action hasn't changed and markets wait the next big move. Volume climbed to register as distribution, which is perhaps the only point of interest today.

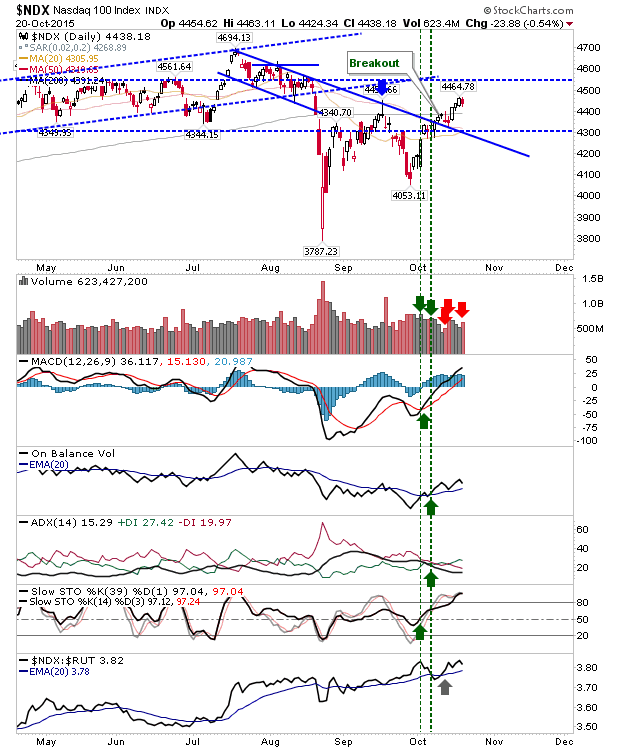

The Nasdaq 100 remains above its 200-day MA but below the jobs-data spike high. Of the indices, it is caught between supply and demand, but technicals are firmly in bulls favour. If bears are going to get joy, then a push below 4,300 will be needed.

The S&P tagged declining resistance in what has so far played as a picture perfect test of resistance. Technicals are in favour of bulls, but a decline from here would attract new shorts.

The Russel 2000 has stayed below the radar, playing to the declining channel in tight action. Watch for a false breakout to tag channel resistance.

Markets are in need of some direction. Recent action suggests a tiring of the respectable rally, but this pause may be the kicker to break past resistance and set markets on to challenge 2015 highs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq 100 remains above its 200-day MA but below the jobs-data spike high. Of the indices, it is caught between supply and demand, but technicals are firmly in bulls favour. If bears are going to get joy, then a push below 4,300 will be needed.

The S&P tagged declining resistance in what has so far played as a picture perfect test of resistance. Technicals are in favour of bulls, but a decline from here would attract new shorts.

The Russel 2000 has stayed below the radar, playing to the declining channel in tight action. Watch for a false breakout to tag channel resistance.

Markets are in need of some direction. Recent action suggests a tiring of the respectable rally, but this pause may be the kicker to break past resistance and set markets on to challenge 2015 highs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!