Daily Market Commentary: Large Caps Remain Primed For Gains

It proved to be a tougher day for Tech stocks than Large Caps. The upside follow through didn't occur, but there was a divergence between losses for Tech stocks and a more neutral, flat day for Large Caps.

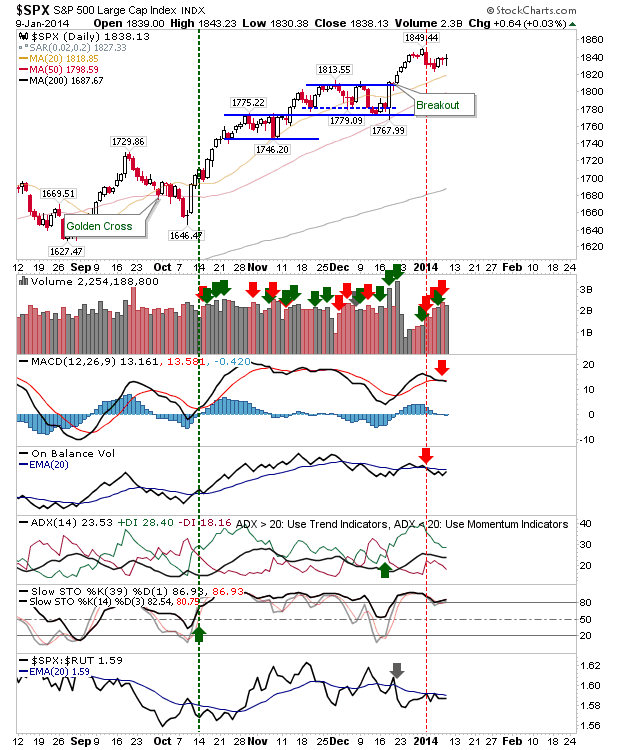

The S&P did lose out in morning action, but was able to recover those losses by the close. 'Sell' triggers for the MACD and On-Balance-Volume remain, but the former looks set to whipsaw if the S&P posts even a small gain.

Tech averages were hit by the scaled back gains in the semiconductor index. Semiconductors did enjoy a big jump on Wednesday, which were enough to register a new closing high, but it was a step too far to see this morph into even a bigger gain Thursday. The day finished with a reversal of the intraday action of Wednesday, but the upside gap remains valid.

This softness played a roll in general Tech weakness. The Nasdaq 100 finished with a bearish engulfing pattern on overbought stochastics - suggesting there will be more downside today. Bulls will look to the 20-day MA at 3,532 to offer support, but an intraday violation is more probable.

The Nasdaq still has converged channel support lines to work off. Its 20-day MA is further away than for the Nasdaq 100, but an intraday low around this MA at 4,105 would not be surprising. However, I think bulls have more to work with over the longer term.

Small Caps have the cleanest picture. The last couple of weeks have shaped a tight trading range (ignoring the bad tick). An upside breakout in the direction of the prevailing trend is more probable. Risk can be assessed on a loss of 1,146.

Going forward. Look for intraday tests of 20-day MAs in the Nasdaq and Nasdaq 100, with the former perhaps offering a longside opportunity at the 20-day MA if tested. Large Caps seem to be hogging most of the money flow, but Small Caps are primed for an upside surprise with the tight trading range and demand at 1,147. If you are a bear looking for shorts, the Nasdaq 100 is perhaps the best bet, but any weakness will have a tough time building momentum given the support levels available.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P did lose out in morning action, but was able to recover those losses by the close. 'Sell' triggers for the MACD and On-Balance-Volume remain, but the former looks set to whipsaw if the S&P posts even a small gain.

Tech averages were hit by the scaled back gains in the semiconductor index. Semiconductors did enjoy a big jump on Wednesday, which were enough to register a new closing high, but it was a step too far to see this morph into even a bigger gain Thursday. The day finished with a reversal of the intraday action of Wednesday, but the upside gap remains valid.

This softness played a roll in general Tech weakness. The Nasdaq 100 finished with a bearish engulfing pattern on overbought stochastics - suggesting there will be more downside today. Bulls will look to the 20-day MA at 3,532 to offer support, but an intraday violation is more probable.

The Nasdaq still has converged channel support lines to work off. Its 20-day MA is further away than for the Nasdaq 100, but an intraday low around this MA at 4,105 would not be surprising. However, I think bulls have more to work with over the longer term.

Small Caps have the cleanest picture. The last couple of weeks have shaped a tight trading range (ignoring the bad tick). An upside breakout in the direction of the prevailing trend is more probable. Risk can be assessed on a loss of 1,146.

Going forward. Look for intraday tests of 20-day MAs in the Nasdaq and Nasdaq 100, with the former perhaps offering a longside opportunity at the 20-day MA if tested. Large Caps seem to be hogging most of the money flow, but Small Caps are primed for an upside surprise with the tight trading range and demand at 1,147. If you are a bear looking for shorts, the Nasdaq 100 is perhaps the best bet, but any weakness will have a tough time building momentum given the support levels available.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!