Daily Market Commentary: Modest Recovery

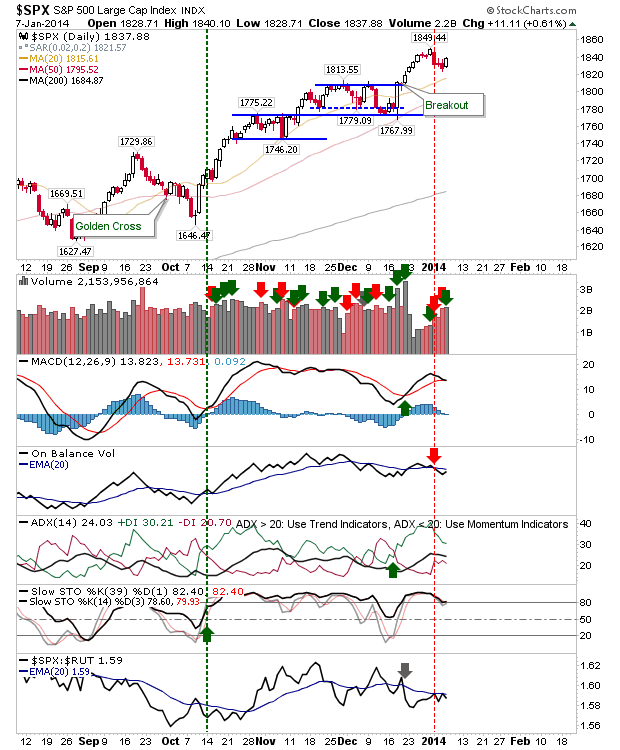

Indices staged a modest recovery, stemming a brief sequence of losses. Long traders can use yesterday's lows as a risk measure, working a potential swing low. The bounce in the S&P occurred well above support, but it's looking like a good opportunity.

The Nasdaq staged a stronger bounce, coming off converged channel support and former channel resistance-turned-support.

The Russell 2000 also held 1,147 support, but the MACD is on the verge of a 'sell' trigger, and other technicals continue to weaken, including the relative shift towards Small Caps.

Wednesday is set up for a continuation of the bounce. Watch for late afternoon buying, particularly if markets lose ground in morning trading. Although an undercut of Monday's lows would suggest bears have more to bring to the table, and a more cautious approach to long positions should be taken.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq staged a stronger bounce, coming off converged channel support and former channel resistance-turned-support.

The Russell 2000 also held 1,147 support, but the MACD is on the verge of a 'sell' trigger, and other technicals continue to weaken, including the relative shift towards Small Caps.

Wednesday is set up for a continuation of the bounce. Watch for late afternoon buying, particularly if markets lose ground in morning trading. Although an undercut of Monday's lows would suggest bears have more to bring to the table, and a more cautious approach to long positions should be taken.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!