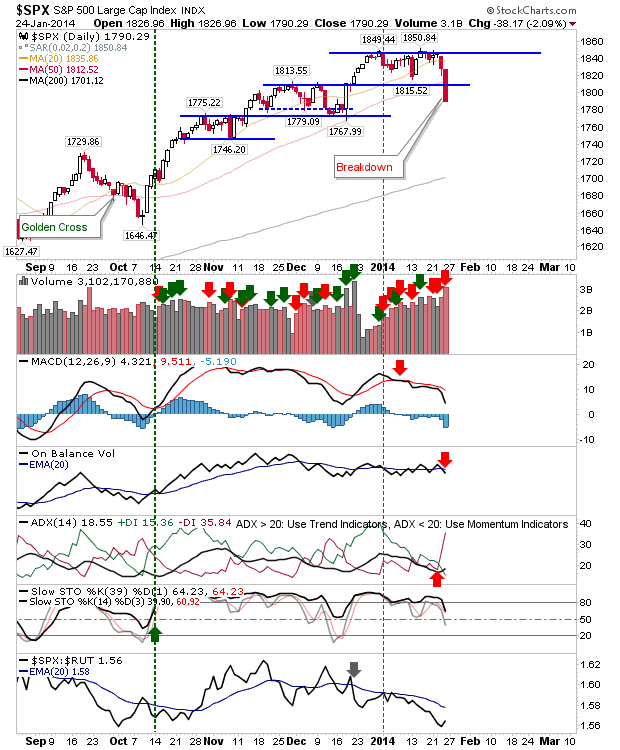

Friday saw big losses across the board. It has been a long time since bears have had much influence as they had on Friday. Breakdowns abound, and areas of overhead supply were created where before there was none.

The S&P sliced through the low end of its range and through its 50-day MA on higher volume distribution. Not surprisingly, technicals weakened, but are still net bullish. The 200-day MA is the long term target, with rallies likely to struggle once the 20-day MA is reached.

The Nasdaq lost support of the October-January channel, dropping it back inside the earlier channel. The 50-day MA is the next target. Technicals are not as bearish as the S&P, but the 4,426 swing high could stick around for a while.

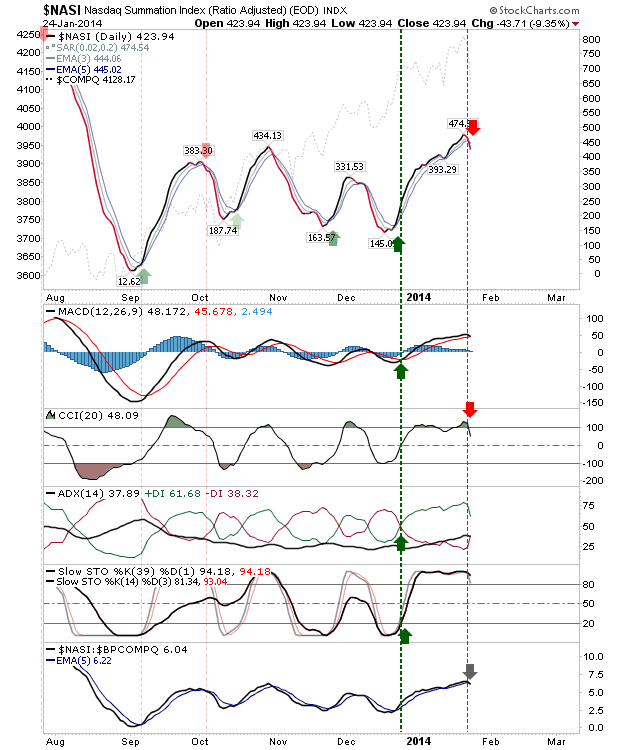

Nasdaq breadth experienced a sharp decline. The Percentage of Nasdaq Stocks above the 50-day MA fell sharply, moving from a recent swing high of 74% to its current 59%. Technicals turned net bearish.

The Bullish Percents also saw big losses, although technicals haven't fully reversed in favour of bears.

The Nasdaq Summation also turned bearish, but without the support of net bearish technicals. This index is usually a good marker of reversals, but since September this particular breadth index has been range bound, and Friday's 'sell' trigger isn't a strong 'sell' - but is still a 'sell' signal.. An undercut of '0' would suggest something more long term bearish, but as it stands, the decline is scheduled to be short lived.

Adding to the bearish picture in the Nasdaq was the 'bull trap' in the Semiconductor Index. This was supported by a 'sell' trigger in the MACD and ADX. The 50-day MA is the next downward target for the index.

Hardest hit was the Russell 2000. Like the semiconductor index, it finished Friday with a 'bull trap'. Losses took the index back to its 50-day MA. Next in line is channel support, and then there is a large gap down to the 20-day MA.

It has been a while since markets experienced the extent of losses from Friday. A quiet Monday is likely on the cards, but any rally will experience supply at 20-day MAs, which will be the new attack area for shorts.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!