Daily Market Commentary: S&P Bull Trap

Today's losses were small, but enough to leave a 'Bull Trap' in the S&P. It was the only real action of note on the day. Lower volume kept this from being a distribution day.

The S&P came close to a test of the 20-day MA with a pending bear cross in the MACD and On-Balance-Volume. There was also a relative shift against the Russell 2000, which is better news for bulls as defense of Small Caps outweighed that of Large Caps.

The Nasdaq opened just above its 20-day MA, but spent the rest of the day advancing. MACD trigger 'sell' probable tomorrow.

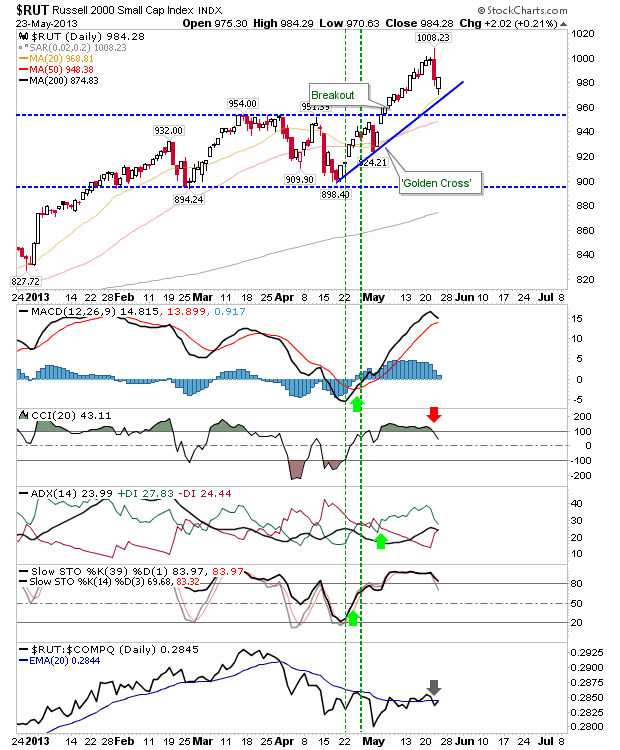

The Russell 2000 defended rising support, and was able to close a little higher.

Tomorrow may see a little more aggression from bulls in the morning, but it will be tough to see significant inroads into yesterday's losses.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P came close to a test of the 20-day MA with a pending bear cross in the MACD and On-Balance-Volume. There was also a relative shift against the Russell 2000, which is better news for bulls as defense of Small Caps outweighed that of Large Caps.

The Nasdaq opened just above its 20-day MA, but spent the rest of the day advancing. MACD trigger 'sell' probable tomorrow.

The Russell 2000 defended rising support, and was able to close a little higher.

Tomorrow may see a little more aggression from bulls in the morning, but it will be tough to see significant inroads into yesterday's losses.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!