Daily Market Commentary: Low Volume Losses

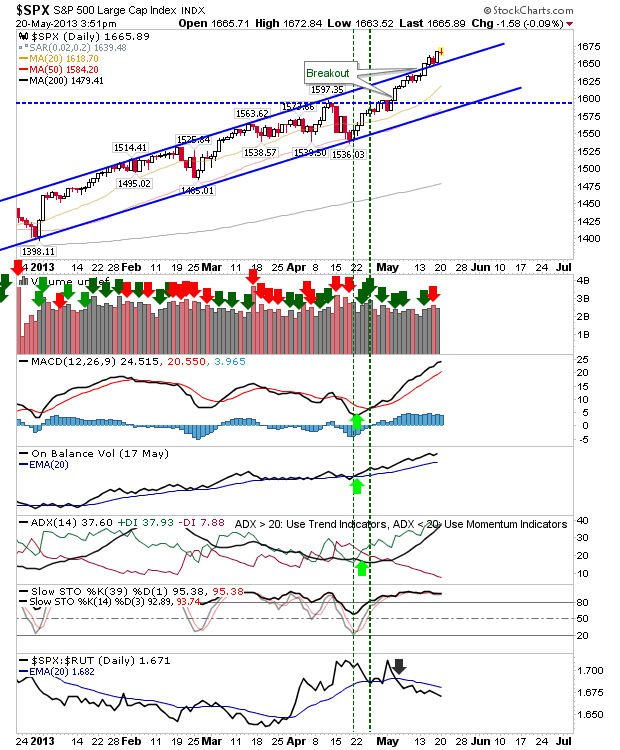

The mini-rally started in mid-April continued to rule the roost. Today's low volume losses continued with the trend which has supported the rally: namely high volume gains, and low volume losses.

The S&P sits 12% above its 200-day MA, which is unusually high. Although the S&P has managed to rally to 20% above its 200-day MA; typically this is done after a major low, and not at the latter stages of an advance. Neither action in the indices or supporting technicals suggest this rally is about to end soon.

The Nasdaq is as similarly extended as the S&P from its 200-day MA, at 12%, but is further from natural support than the latter index.

Helping the bullish cause is the Percentage of Nasdaq Stocks above the 50-day MA, which has yet to reach prior overbought territory in the 80th percentile (it currently sits at 70%). Again, another indication this rally may have more room to run higher.

However, the Nasdaq Summation Index has again come back to the area of its last high - and possible resistance.

The Russell 2000 has managed to make relative gains against the Nasdaq. This is better news for the continuity of the rally, at least for Small Caps.

While the rally has been narrow and steep, there isn't an indication a top is going to develop. For this to happen there will need to be a retest of the high, and at the moment, this high has yet to be confirmed.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P sits 12% above its 200-day MA, which is unusually high. Although the S&P has managed to rally to 20% above its 200-day MA; typically this is done after a major low, and not at the latter stages of an advance. Neither action in the indices or supporting technicals suggest this rally is about to end soon.

The Nasdaq is as similarly extended as the S&P from its 200-day MA, at 12%, but is further from natural support than the latter index.

Helping the bullish cause is the Percentage of Nasdaq Stocks above the 50-day MA, which has yet to reach prior overbought territory in the 80th percentile (it currently sits at 70%). Again, another indication this rally may have more room to run higher.

However, the Nasdaq Summation Index has again come back to the area of its last high - and possible resistance.

The Russell 2000 has managed to make relative gains against the Nasdaq. This is better news for the continuity of the rally, at least for Small Caps.

While the rally has been narrow and steep, there isn't an indication a top is going to develop. For this to happen there will need to be a retest of the high, and at the moment, this high has yet to be confirmed.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!