Daily Market Commentary: Significant Accumulation

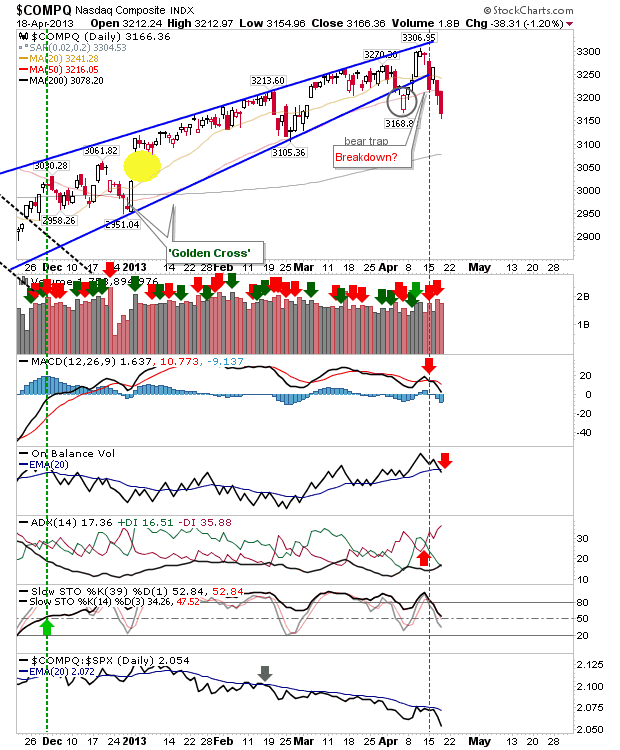

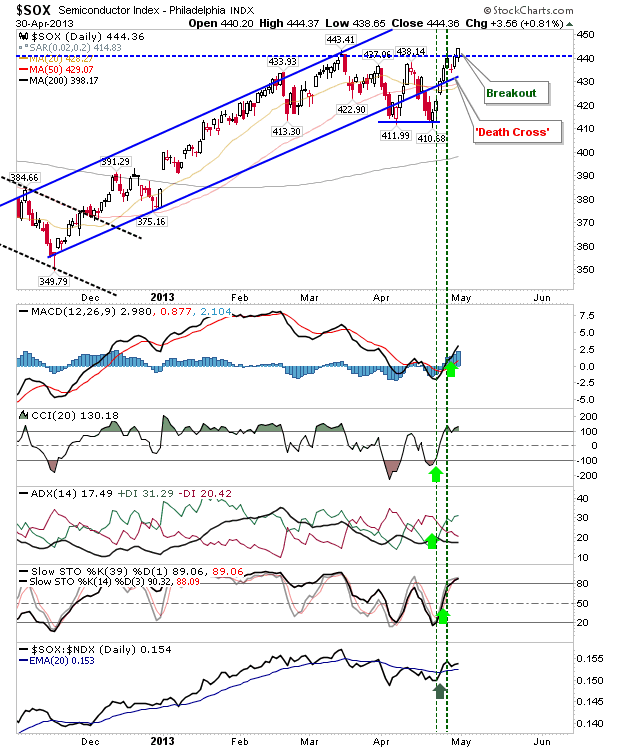

Technology spent another day in the headlines. Yesterday there was a breakout in the Nasdaq, now today there was heavier volume buying to back it up. The semiconductor index is the 'news' index to follow. It's breakout will largely determine how long the rallies in the Nasdaq and Nasdaq 100. Technicals are net bullish, another tick in the bullish column for these indices. Even the 'Death Cross' might not last too long.