A tick in the calendar as today's non-event keeps markets on track for breakouts

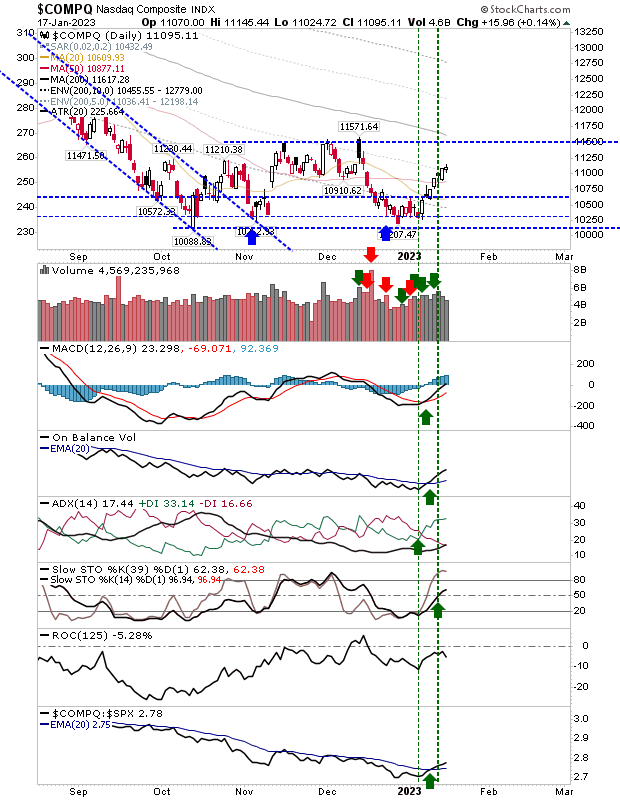

A pause in the Santa rally keeps things on track without confirming anything. The Nasdaq had the best of the action by virtue of its modest close higher, but really, there wasn't much in it for any of the indices. Volume was below Friday's, so no registered accumulation day, but it did at least add to the bullish trend in On-Balance-Volume.

The S&P finished with a neutral doji, but at least had the decency to hold on to 200-day MA support. What it wasn't able to do was make back some of the horrific loss in relative performance to peer indices.

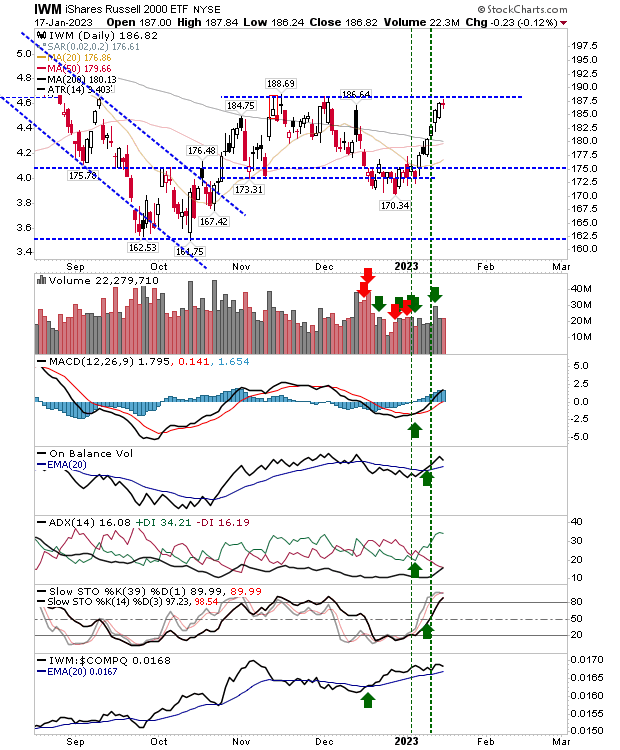

The Russell 2000 ($IWM) closed with a doji at resistance. Of the lead indices it has the best technical strength - it just have to deliver with a breakout.

As a final note, as this might prove to be important in the coming days, the Dow Industrial Average lost just over 1% on higher volume distribution. While this index is the closest to making new all-time highs, a shift away from Large Caps to more speculative growth stocks should be beneficial in the long run.

So, we look at tomorrow and see if traders can shift the needle.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.