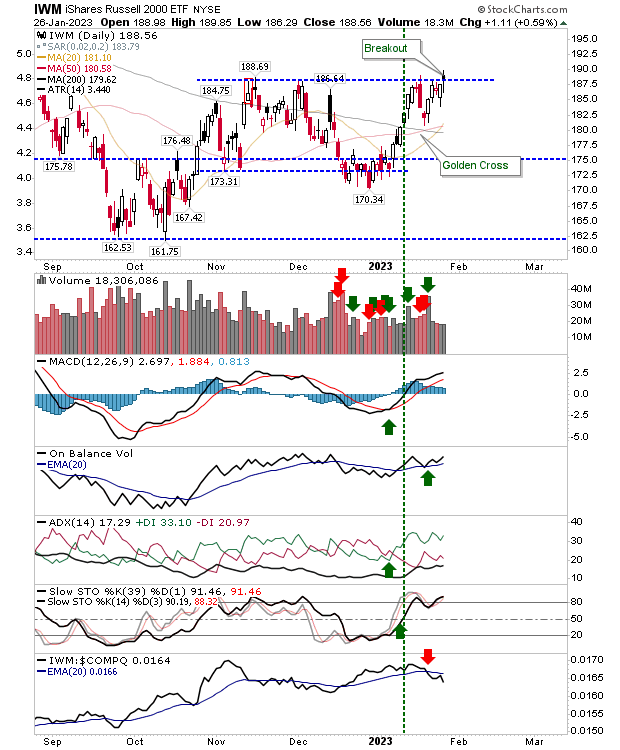

Russell 2000 breakout?

I'm not entirely convinced by the Russell 2000 resistance break, primarily because it has triggered on a 'black' candlestick, typically a bearish candlestick. Volume wasn't great, but there is a significant 'golden cross' between 50-day and 200-day MAs that should bring some bullish momentum with it. Technicals are good, but there is the relative undperformance against the Nasdaq. Let's see what tomorrow brings.

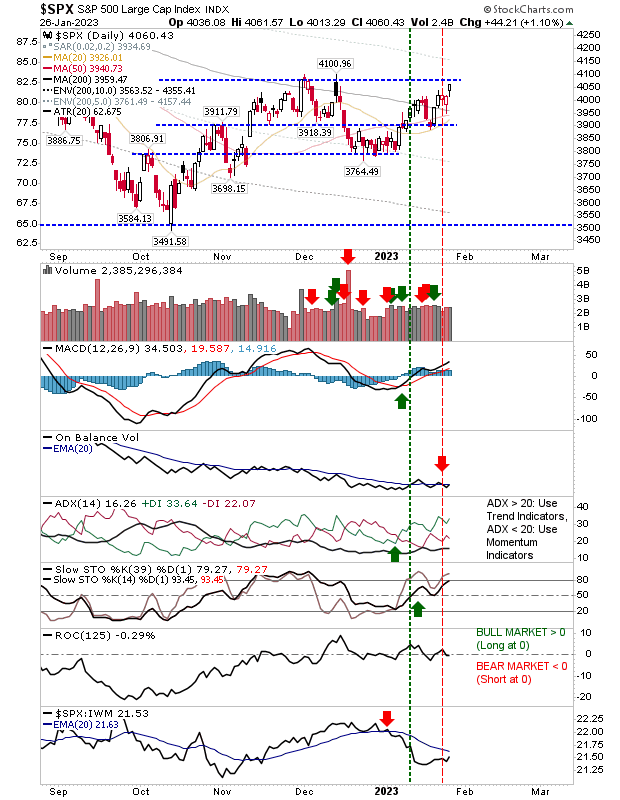

The Nasdaq gapped higher, lost ground through the day, but finished a little higher and bang on resistance. There was no breakout, but it's primed to moved higher. The one catch is the added resistance at its 200-day MA. Technicals are excellent, including relative outperformance against the S&P and Russell 2000.

The S&P also edged towards resistance but isn't quite there yet. It does have the benefit of trading above its 200-day MA. If there is a catch it's that On-Balance-Volume has been trending lower while the index has moved sideways. There is also a 'sell' signal in the indicator, but this is flip-flopping around, so I wouldn't worry too much about that - the bearish trend is more worrisome (and the sharp underpeformance against the Russell 2000 is not great either).

For tomorrow, eyes on the Russell 2000. It's a key index to drive secular bull markets and it will be the lead out. I don't see too much of concern, despite the bearish flags I mentioned earlier. I think the overall momentum is very much on bulls side. The fact there is still plenty of bearish chatter in the social media world will be to the markets benefit.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.