Post-Covid New Year has a sluggish start for Markets.

As a birthday treat, I finally grabbed a dose of Omicron, delivering enough fun and games to keep me low for the early part of the week. The New Year is well underway - and the market - well, it hasn't done a whole lot since I last left it.

People have stopped believing in Santa, and market action was all a bit slushy, so what have we to look at. The S&P is holding the support level defined back in the early October swing high. Volume has picked up on the slow return of traders as On-Balance-Volume continues to trend downwards. We have a switch back to the underperformance against the Russell 2000. Optimists might look to the upcoming MACD trigger 'buy'. At this stage, given the length of the consolidation, and its compactness, it looks like one that will break lower.

The Nasdaq has its own consolidation, and although there is still a chance we have a bounce here, it's going to have it to do from its own end-zone. Technicals are net bearish and not looking great. Optimists would look to heavily oversold conditions in stochastic momentum as a kickstart, but relative performance continues to degrade.

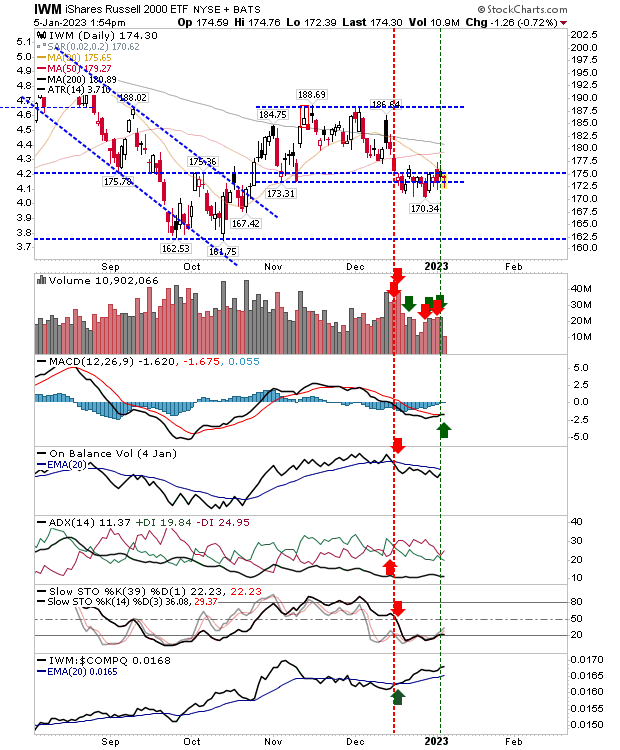

The Russell 2000 consolidation has morphed into one comparable to the one in the S&P. The one big difference is the new MACD trigger 'buy', plus it has the attraction of being the peer market leader.

The most bullish setup is in the Dow Industrial Average. Yes, we have a similar consolidation as the S&P and Russell 2000, but this consolidation is running close to all-time highs and has the 50-day MA to assist in a bounce (following the mid-December `Golden Cross`). The MACD trigger 'buy' is close, but other technicals - stochastics in particular - are still disappointingly bearish.

The longer these consolidations last, the more likely they will break southwards. Having said that, there is a good chance for the Dow Jones Industrial Average or the Russell 2000 to lead out and bring the Nasdaq and S&P with them; but should either of the latter two indices crack lower, then it will be a long winter.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.