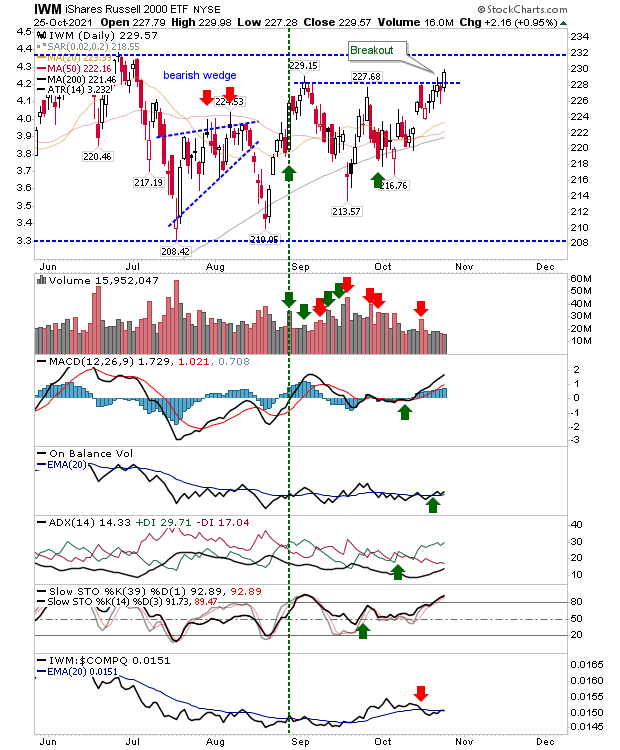

The Russell 2000 breaks out in an anticipated end to the 2021 trading range

It has taken the best part of a two months but it has finally managed to clear resistance and is well placed to finally put an end to the 2021 trading range. Technicals are net positive and relative performance is on the verge of a return to new market leadership.

The S&P was able to enjoy a breakout alongside the Russell 2000. In the process of its breakout it also returned a performance advantage over the Russell 2000 - but both indices are leading out new rallies.

The Nasdaq also recovered Friday's loss, and while it hasn't yet reached the September high it does have the benefit of nearby support. Technicals are net positive and there are no bearish divergences to worry about.

For Tuesday, we will want to see some follow through from the Russell 2000, or at the least, a continued close above breakout support (an intraday spike low below breakout support would be acceptable). As long as the Russell 2000 can build on today's move it will take the Nasdaq and S&P along with it.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.