S&P challenges all-time highs

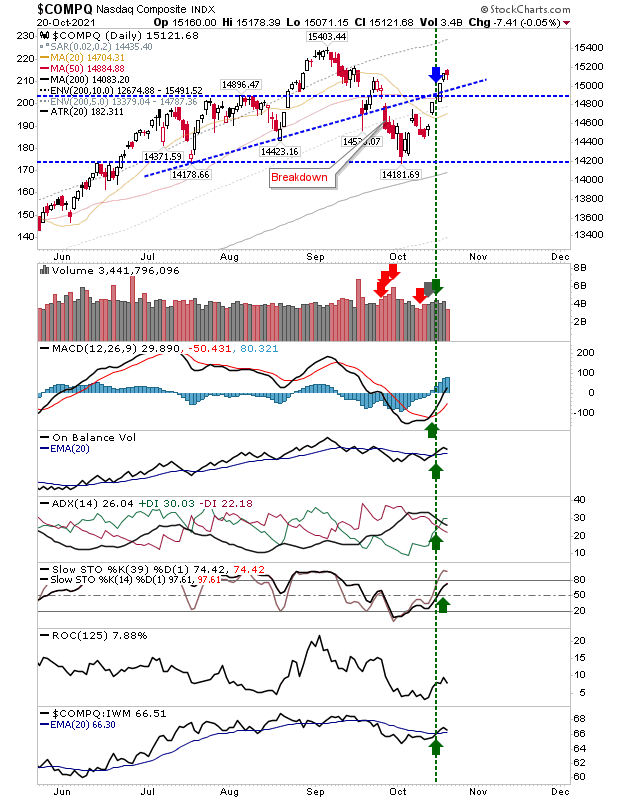

Once the Nasdaq broke through resistance (former support) defined by the July and August swing lows it has managed to hang on to regained support. Technicals are net positive and the index is again outperforming the Russell 2000. It still has some way to go before it challenges the September high and finished today with a small bearish candlestick.

The S&P has managed to reacha point to challenge the August high. It managed to do so on higher volume accumulation, although following the sequence of bullish white candlesticks I would expect it to now consolidate - perhaps forming a 'bull flag' before forming new highs.

First we had the Nasdaq recovering from its breakdown, now we have the S&P challenging all-time highs and soon we could see the Russell 2000 clear its 2021 trading range. All of these point of a return to a bull market and with the end of the pandemic not likely until sometime next year, we are unlikely to see a 'sell the news event' before then.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.