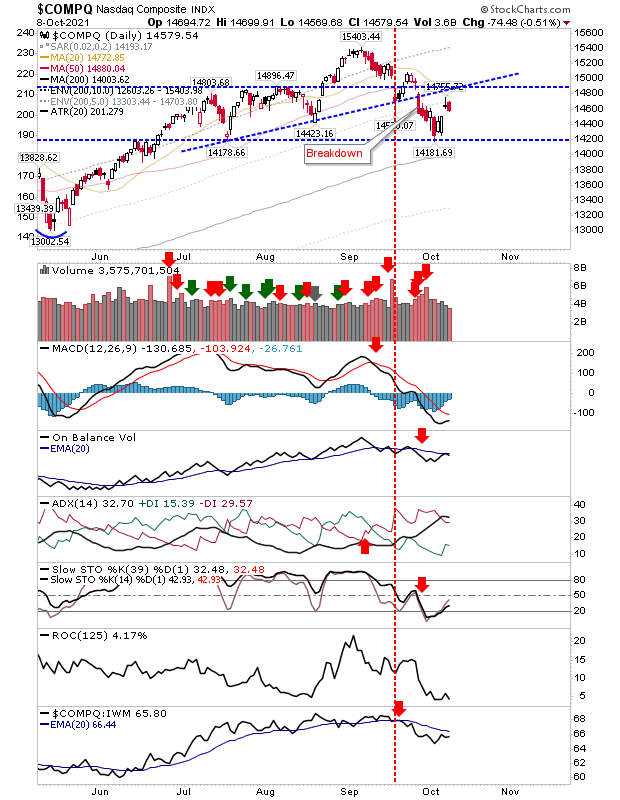

Small bearish engulfing patterns for markets

In candlestick terms, markets finished Friday with a series of bearish engulfing patterns against Thursday's 'real body' finishes. It did put a bit of a dampner on Thursday's bounce although the extent of the losses were relatively minor.

Watch for a test of the gap early next week. Aggressive traders could 'buy' the test and set a stop on a loss of the swing low at 14,100, although a close below the gap would probably offer enough reason to sell before the stop.

It's a similar situation for the S&P, although it sits further away from its 200-day MA. If there was measured move lower it would have a target around 4,075 - still enough to undercut the 200-day MA. Technicals are not as bearish with a 'buy' in On-Balance-Volume and a pending 'buy' in the MACD; although, the latter is below the bullish zero line.

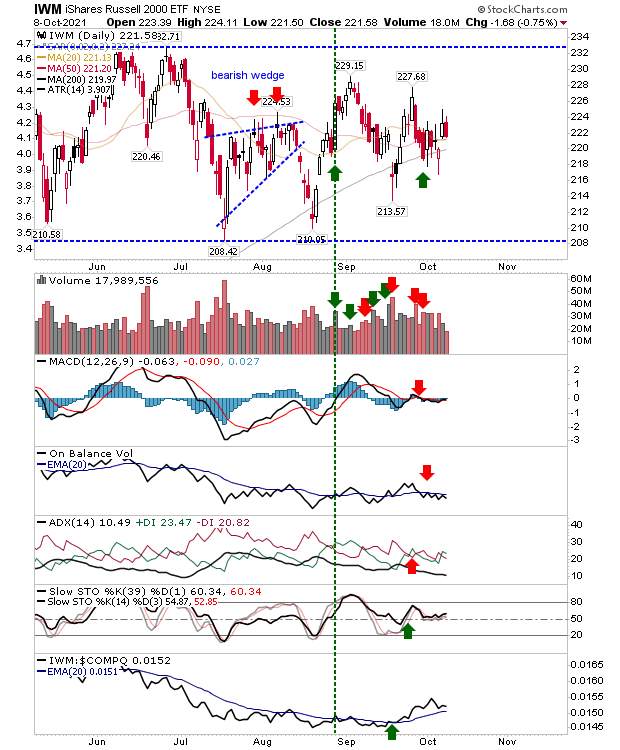

The Russell 2000 didn't quite complete its bearish engulfing pattern as it bounds around its 200-day MA. While the index is range bound it's neither bullish nor bearish. Stochatics are nicely positioned above the mid-line with the index in the process of outperforming its peers. It just needs to challenge the summer double top.

Investor sentiment has shifted in favor of bears, although it's still early days. Bearish sentiment was rising before Covid hit in 2020, it just got an extra boost with the pandemic started. Bullish sentient did ride a crest of a wave for most of the course of the pandemic, but now pessimism is making a reappearance and it might be early next year before we know the full extent of market particpant concerns.

Lets see what tomorrow brings. Bulls will want to see early strength and any weakness covered off in the opening half hour. If selling lingers into the afternoon it could get ugly.

You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

on Twitter

Investments are held in a pension fund on a buy-and-hold strategy.

.