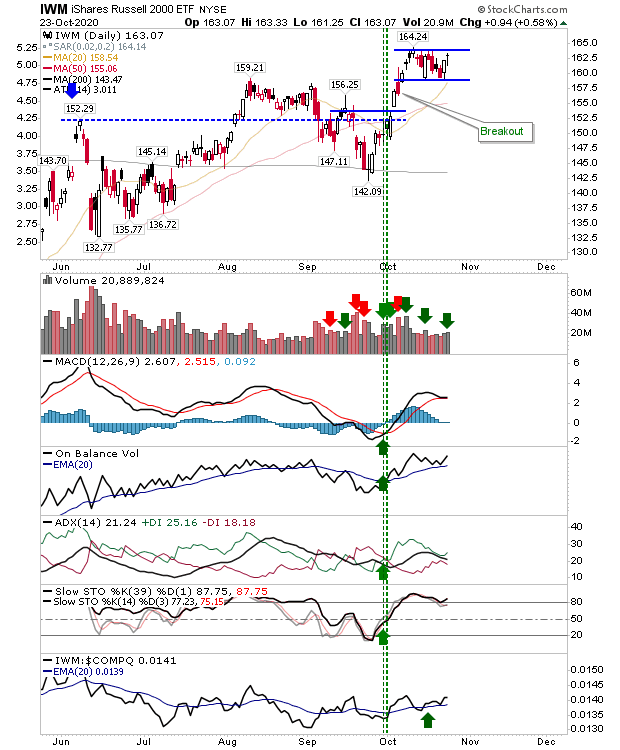

Russell 2000 Shapes Bullish Handle

Watching the (Covid19) World Series so will be keeping this post short. The main thing from Friday is the solid bullish handle taking shape in the Russell 2000. The breakout hasn't occurred yet, but the setup is looking good for the coming week. Technicals are all bullish. A stop would go on a loss of handle support and/or the trailing 20-day MA.

As a bonus, I do have one potential trade for Monday; you can read about it here with my comments on #sectobreadth 'sell' sector Utilities ($XLU) here.You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.