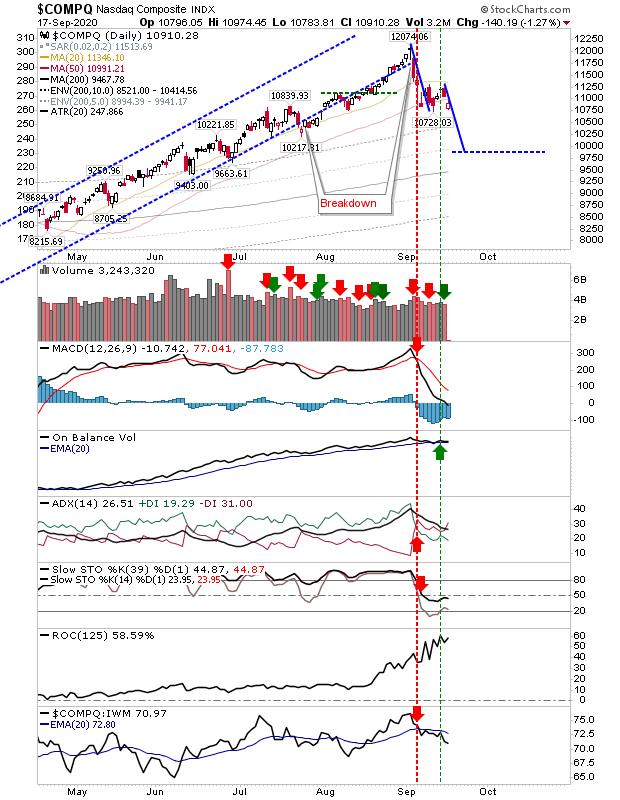

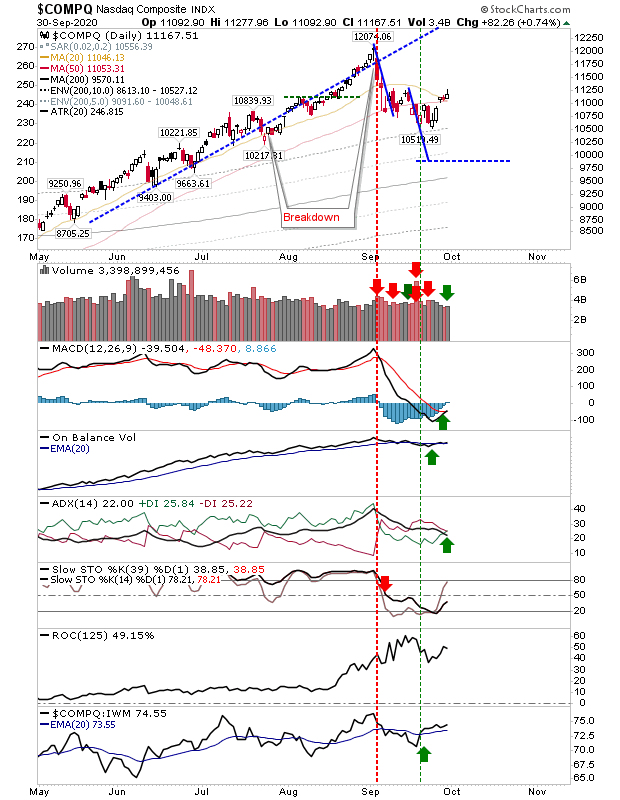

Markets attempt to rally but fall short by the close

It was looking good for the indices in early m the day, but by the close indices weren't able to hold on to their gains. However, all indices finished in positive territory and any (small) upside tomorrow would likely be sufficient to maintain momentum. The Nasdaq closed today with a 'buy' trigger in the MACD and ADX, along with a 'buy' trigger in On-Balance-Volume.The Nasdaq is outperforming the Russell 2000 and while it has enjoyed just over a week's worth of gains it has so far resisted the initial move to the measured target.