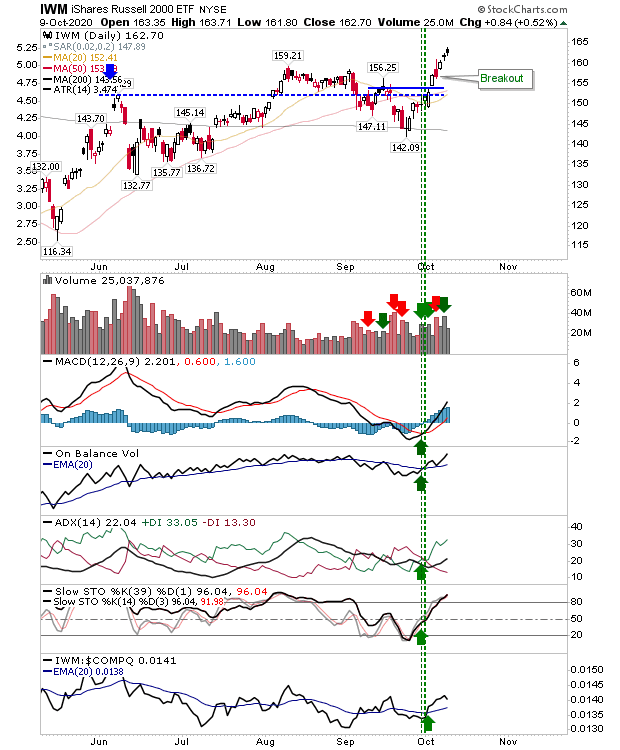

Russell 2000 Closes Week At New Swing High

Another day when Small Caps maintained their run of good form by closing above the August swing high, but buying volume was down on Thursdays. Technicals remain net bullish and have been since before the mini breakout in October. The only downside was the 'black' candlestick - a higher open but lower close; a close above prior day's close - 'black' candlesticks at a swing high typically mark reversals, so it will be important for buyers on Monday to make a close above the high of this candlestick to negate its potentially bearish implications.

Both the Nasdaq and S&P continued to shape right-hand bases as they look to recover from the losses of August. The S&P remains in the 85% zone of historic price extremes relative to its 200-day MA and the Nasdaq is the 90% zone; both indices had reached the 95% zone in September. Even now, the Russell 2000 is only a fraction of a percentage point from getting into the 85% zone. These scenarios have in the past marked swing highs of consequence, but buyers are doing their best to ensure this will not be the case for a while yet.You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.