Sellers Control Friday's Action - But Monday Will Be The Real Test

All indices suffered selling on Friday, although selling volume was light, but given the Trump announcement after the Friday close it's hard to see anything but selling on Monday. The context to the selling will be a bounce that has struggled to reach the highs of August. Traders who were waiting for a retest of August highs before selling may find themselves doing this sooner. The lead in candlesticks to Monday will not help the mood.

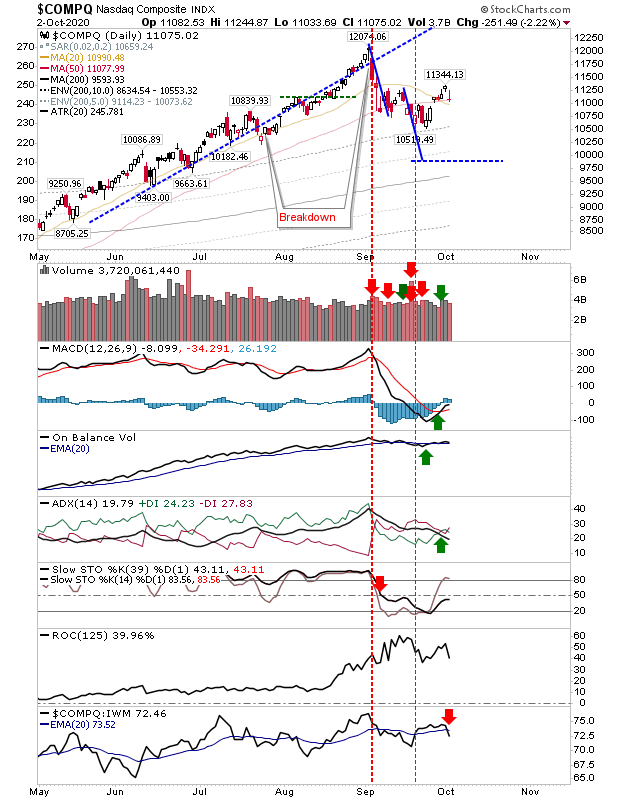

The Nasdaq looks to have finished with a bearish 'evening' start reversal. The 'buy' signal in the MACD, On-Balance-Volume and ADX are still intact, but I doubt all will survive by Monday's close. The 50-day MA is also support (for now). Stochatics are firmly on the bearish side of the divide (anything below 50 is bear market land). The index has also returned to a period of underpeformance relative to the Russell 2000.

The S&P is in a similar state as the Nasdaq although it finished the week before its 50-day MA. It too has a 'buy' trigger in the MACD and On-Balance-Volume, but is also underperforming against the Russell 2000.You've now read my opinion, next read Douglas' blog.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

.