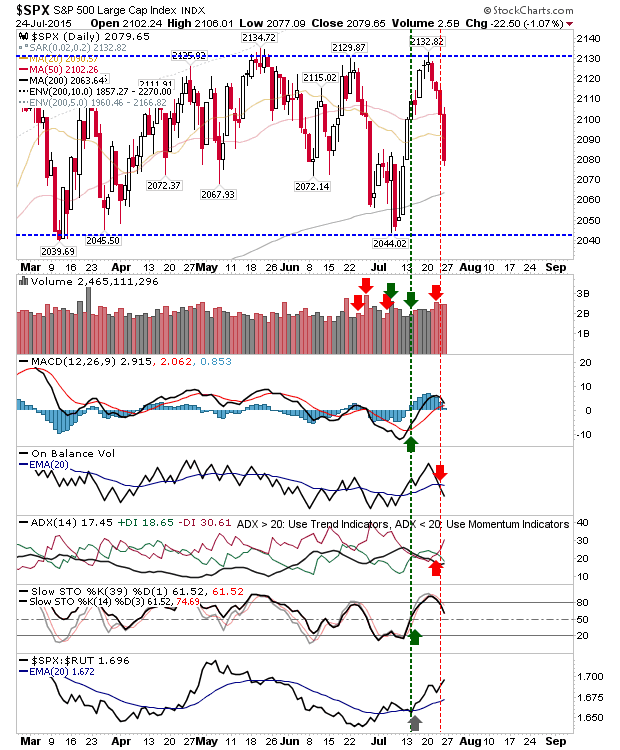

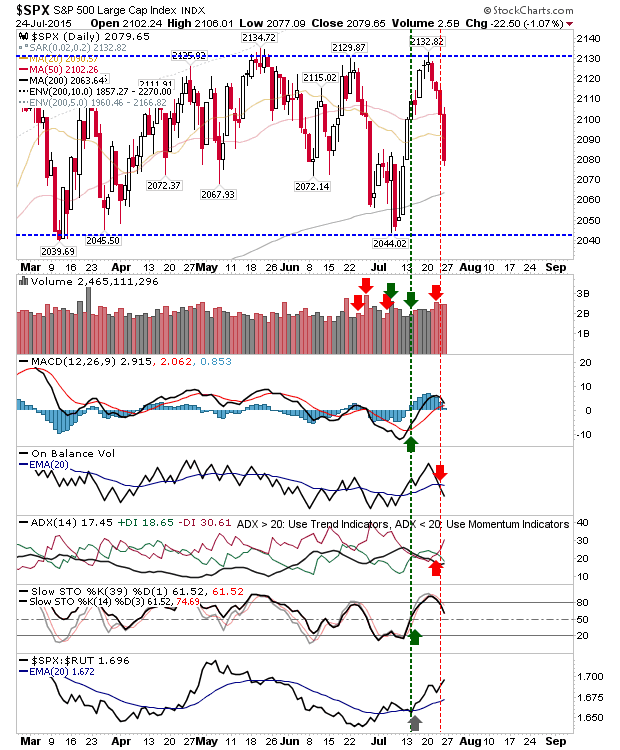

There was no doubt as to the nature of Friday's action. A weak, end-of-week close adds to the negative tone, suggesting the damage is more long term. However, not all indices are in true bearish mode.

The S&P is stuck inside its range, and won't be challenging range lows until 2,045 comes into play. The 200-day MA at 2,063 is an area to look for buyers, although the last test of this key moving average was in early July, which is a little too soon for a new test to hold again. Technicals are mixed, which fits with what is trading range action. Bears may win in the long term, but bulls may get some joy at the 200-day MA for a short term bounce play.

The Dow is not playing so well. It's struggling with a potential break of the trading range, not something S&P traders will want to see succeed. The undercut of the 200-day MA with a new lower high looks quite damaging. Add a new distribution day, one of a recent sequence of three, piles on the bearish pressure. Net bearish technicals is the final icing on the cake. Bulls won't regain control until 18,200 is breached to the upside, but a recovery above 17,625 would force shorts to cover and offer bulls something to work with over the next couple of days.

Damaging is the action in the Russell 2000. The index lost rising trendline support, but it will quickly find itself up against the 200-day MA; a test last (successfully) made in January. Technicals are net negative. The next major support test will be 1,100.

The Semiconductor Index took heavy losses, bringing it back to lows. A strong 'sell' trigger remains in play with the MACD.

The Nasdaq is working off a 'bull trap', but only has one supporting technical on a 'sell' trigger. It also has converged 20-day and 50-day MAs to lean on too. If buyers are able to step up to the plate on Monday, then the tech indices may be the one to deliver the reward.

After the series of hard hits last week, tomorrow may see a more positive start. Tech indices are best positioned to see a long term benefit, but the Dow may offer the lowest risk going forward given its proximity to range support.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for

Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!