Losses Maintained

The back and forth continued, except this time pre-market gains could not be held and markets revisited lows. This lows still hold as support, but it's a tough sell to buyers to want to jump in here.

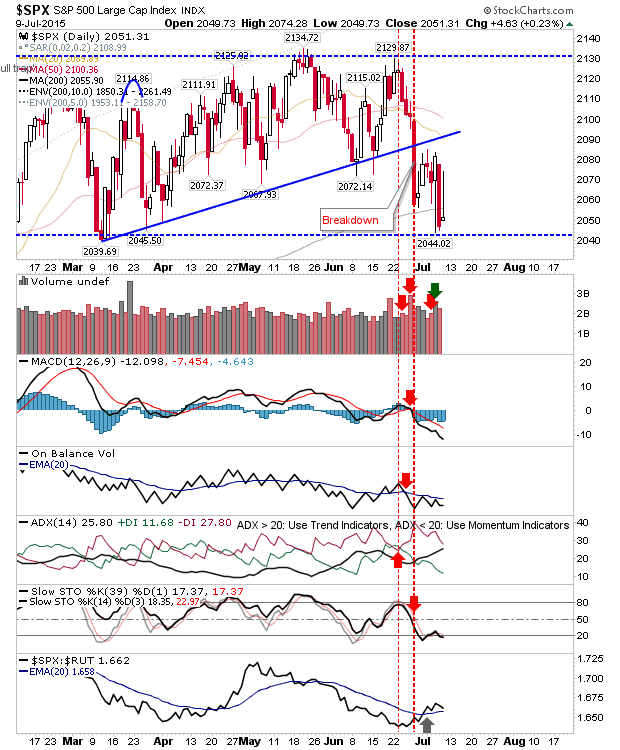

The S&P finished below it 200-day MA with a big inverse hammer. Technicals are net bearish, except today's action hasn't reversed the net out performance of the Large Caps over Small Caps.

Small Caps also experienced losses, but not enough to break trendline support or revisit yesterday's lows. It still might offer the better of the long opportunities, but given it's coming off a 'bull trap' I suspect not.

The Semiconductor Index had the worst of today's losses. It's action will be critical in the months ahead as a marker for a recovery in the economy (of China in particular). So far, it has a very ugly chart and is experiencing a major underperformance against the Nasdaq 100.

The damage in the Semiconductor Index hasn't fully exhibited itself in the Nasdaq 100, although there is little of merit to recommend to bulls. A tag of the 200-day MA might offer more.

Will volatility spike once more? A 2011 style spike would be welcome. With a touch of 20 it's nicely set to generate such a spike, but as this is a monthly chart it may take a couple of months to deliver (assuming a spike emerges).

I should add, I have a short bias here, but given major lows typically come after the S&P is 10% below its 200-day MA I would be inclined to favour further losses before we have a strong low. Past declines have deceived in the past, and it has been 4 years since the last strong low, but it will come.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P finished below it 200-day MA with a big inverse hammer. Technicals are net bearish, except today's action hasn't reversed the net out performance of the Large Caps over Small Caps.

Small Caps also experienced losses, but not enough to break trendline support or revisit yesterday's lows. It still might offer the better of the long opportunities, but given it's coming off a 'bull trap' I suspect not.

The damage in the Semiconductor Index hasn't fully exhibited itself in the Nasdaq 100, although there is little of merit to recommend to bulls. A tag of the 200-day MA might offer more.

Will volatility spike once more? A 2011 style spike would be welcome. With a touch of 20 it's nicely set to generate such a spike, but as this is a monthly chart it may take a couple of months to deliver (assuming a spike emerges).

I should add, I have a short bias here, but given major lows typically come after the S&P is 10% below its 200-day MA I would be inclined to favour further losses before we have a strong low. Past declines have deceived in the past, and it has been 4 years since the last strong low, but it will come.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!