It's not looking good for

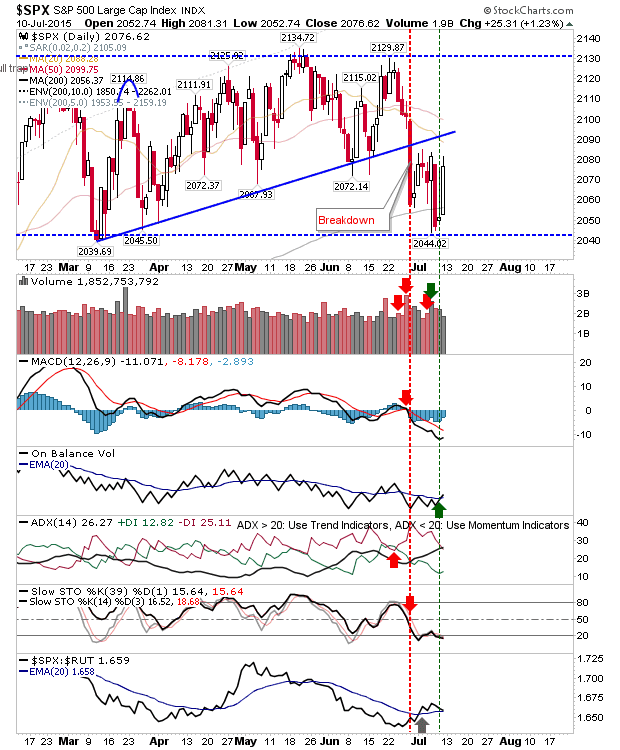

Greece with Germany holding out, and last week's big swings without any significant change in price is going to change next week. The break down from the end of June looks likely to hold out, and this will keep the intermediate down trend in play. Intermediate trends last from 3 weeks to 6 months, and there is probably enough fuel from Greece and China to keep this going into Autumn.

Bulls are not entirely out of the game. The S&P is defending its 200-day MA, with a new 'buy' trigger in On-Balance-Volume, and a continued relative advance against Small Caps. Gap resistance is at 2,085.

The Nasdaq also saw an On-Balance-Volume 'Buy' trigger, although the latter volume indicator has flat-lined. Gap resistance for this index sits at 5,038 with the 200-day MA the next target down.

The Russell 2000 defended trend-line support, but next week will be a tougher test. Such support is unlikely to survive a fourth test.

Tech indices will be watching the hard hit Semiconductor Index. The February swing low was defended on Thursday, but bigger tests lie ahead.

There isn't much to be said until the Greek decision is priced in. The twin storms of Greece and China offer a good opportunity to sit back and let the market wash itself out. Long term investors don't need to be in a hurry to invest given the length of this rally (from 2009) with only one major pullback in 2011. Short term traders will need to be nimble with all the day-to-day gaps.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for

Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!