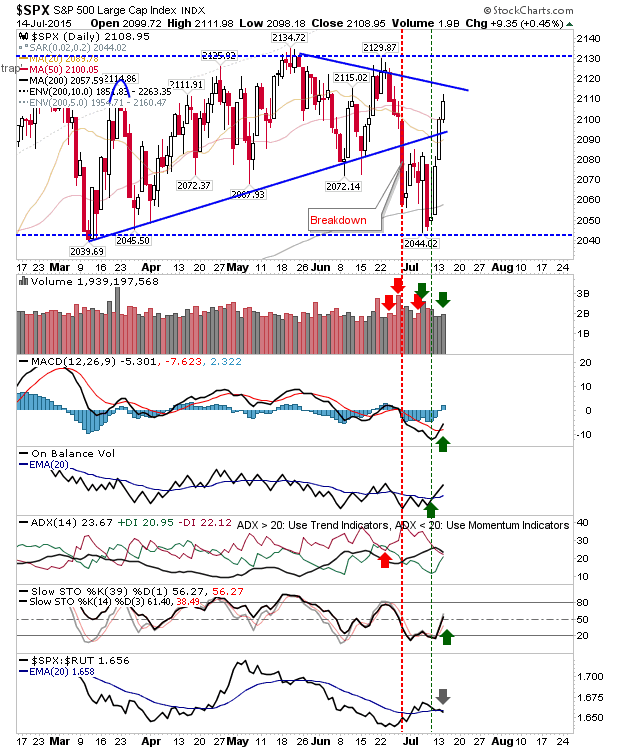

Just when it looked like Greece and/or China were going to bring the long awaited decline of substance, along come bulls to bid up three solid days of gains. Tuesday's rally was enough to register an accumulation day to boot.

The S&P is close to tagging declining resistance from the May-June swing highs. Will bears look to attack here? Technicals have seen some improvement with a MACD trigger and Momentum 'buy', although relative underperformance against Small Caps expanded.

The Nasdaq went a step further and has tagged converged resistance of 5,096 (where the bull trap emerged), and trendline of former support turned resistance. Technically, it went a step further than the S&P with a net bullish technical turn.

The Russell 2000 is another index on the verge of challenging the 'bull trap'. Technicals are not quite as good shape as for the Nasdaq (and the index is experiencing a relative underperformance to the latter index). Prices will inch into the 'bull trap' when it gets above 1,278.

The index which may offer shorts the best chance is the Nasdaq 100. It finished today just below the crux of converged resistance of trendline and 4550. The latter is major resistance and a logical place for shorts to get busy. Bulls will be looking to net bullish technicals to drive a break. Lots to play for on both sides.

For tomorrow, watch tech indices and how they react at converged resistance. Weakness here will likely spread to Large and Small Caps. However, if the Nasdaq 100 is able to break above 4550, then things become much more bullish all around.

For those who may be interested, I will be in London as a guest of eToro as part of their Popular Investor program. I believe the session is to be broadcast tomorrow from 5:30 to 9:00 pm GMT.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for

Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!