Daily Market Commentary: Bears Edge Friday

Friday was a relatively disappointing day. The tight action of Wednesday and Thursday gave way to broader range day on Friday, but there was no strong swing one side or to the other - despite jobs data to spice the action. It only whipsawed traders who played the break of the mid-week narrow range.

The Nasdaq was the only index to suggest there is a (slight) edge to bears. Shorts may decide to take a sniff for a second test of breakout support. Stops on a break above 4,371.

The S&P doesn't really have an obvious trade on offer for the near term. Over an intermediate time frame, buying a push back to 1,850 with a stop on a loss of 1,834 is perhaps the best option to look for. The longer the market holds above 1,850, the more significant this support level becomes.

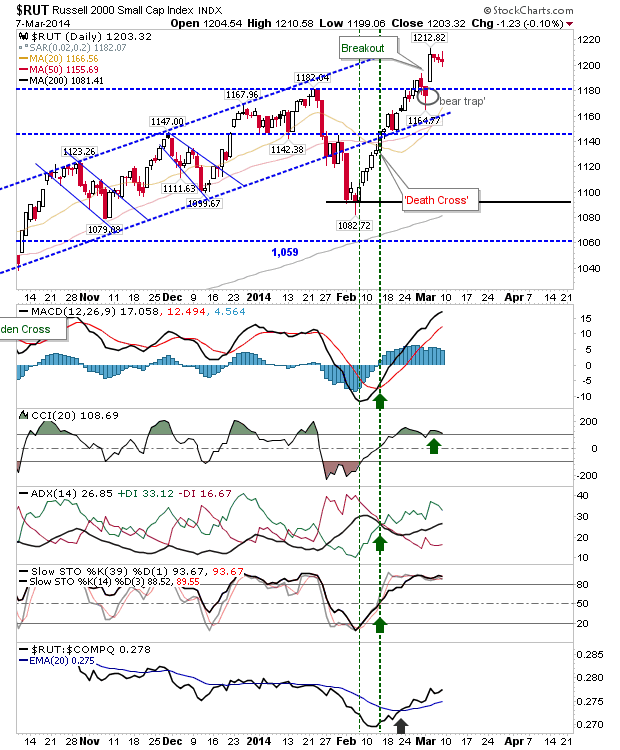

The Russell 2000 is also easing up, with a third challenge on 1,210 failing. This creates a near term opportunity for a short play back to 1,180. Stops on a close above 1,210. I would expect a strong response from buyers if prices approach 1,180, so one may need to be vigilant should prices get down to Tuesday's breakout gap.

Of note on Friday was the return of the Nasdaq Summation Index to overbought territory. It has been a very clean rally for this breadth metric, but it's now at a level which have previously marked tops. Given Thursday's and Friday's bearish action in the Nasdaq, the likelihood for further downside in this index looks favoured.

Likewise, the Percentage of Nasdaq Stocks above the 50-day MA is just shy of the 70% mark. Tops typically occur in the 70s; the highest peak was 85% which followed the bounce after the Tech crash. So the Nasdaq is nearer a sell than a buy.

The Nasdaq Bullish Percents have clustered above 65% dating back to 2013, but a spike low to at least 50% is long overdue.

For next week, a tentative short remains in play. The Nasdaq may be edging it on a risk:reward basis, but all markets are vulnerable. These warning signs have been picked up elsewhere, e.g. McClellan Financial Publications. Long term holders probably haven't too much to fear; while the bull market is long in the tooth in cyclical terms, on a secular time frame it's still early days. Any downtrend is unlikely to hurt long term holdings for very long.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq was the only index to suggest there is a (slight) edge to bears. Shorts may decide to take a sniff for a second test of breakout support. Stops on a break above 4,371.

The S&P doesn't really have an obvious trade on offer for the near term. Over an intermediate time frame, buying a push back to 1,850 with a stop on a loss of 1,834 is perhaps the best option to look for. The longer the market holds above 1,850, the more significant this support level becomes.

The Russell 2000 is also easing up, with a third challenge on 1,210 failing. This creates a near term opportunity for a short play back to 1,180. Stops on a close above 1,210. I would expect a strong response from buyers if prices approach 1,180, so one may need to be vigilant should prices get down to Tuesday's breakout gap.

Of note on Friday was the return of the Nasdaq Summation Index to overbought territory. It has been a very clean rally for this breadth metric, but it's now at a level which have previously marked tops. Given Thursday's and Friday's bearish action in the Nasdaq, the likelihood for further downside in this index looks favoured.

Likewise, the Percentage of Nasdaq Stocks above the 50-day MA is just shy of the 70% mark. Tops typically occur in the 70s; the highest peak was 85% which followed the bounce after the Tech crash. So the Nasdaq is nearer a sell than a buy.

The Nasdaq Bullish Percents have clustered above 65% dating back to 2013, but a spike low to at least 50% is long overdue.

For next week, a tentative short remains in play. The Nasdaq may be edging it on a risk:reward basis, but all markets are vulnerable. These warning signs have been picked up elsewhere, e.g. McClellan Financial Publications. Long term holders probably haven't too much to fear; while the bull market is long in the tooth in cyclical terms, on a secular time frame it's still early days. Any downtrend is unlikely to hurt long term holdings for very long.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Mar8d.png)