Daily Market Commentary: Small Caps Rout

A day of hidden losses. The S&P rejected a fresh test of resistance, but didn't take significant losses by the close. Volume climbed to register distribution, but it was well below Friday's whopper volume.

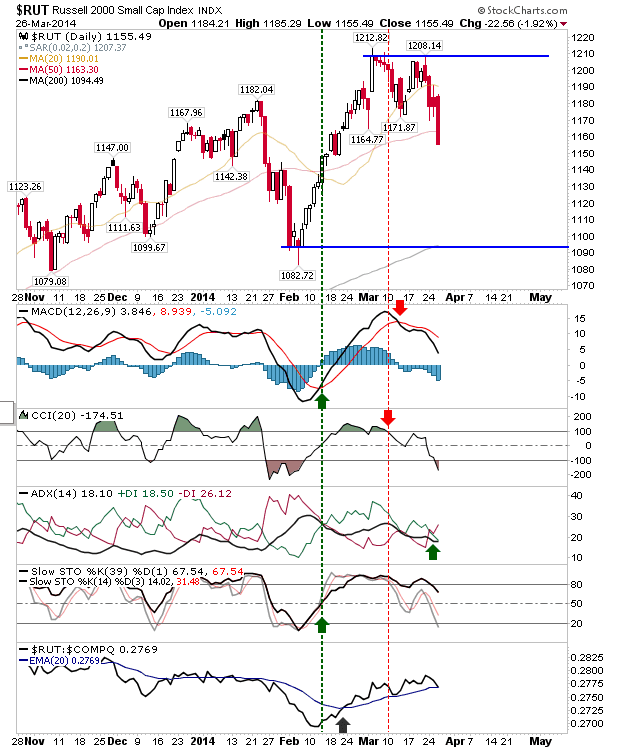

However, Small Caps took a big hit, dropping nearly 2% as buyers stayed away. Losses were quick to undercut the 50-day MA and the March swing low. Next up is the February swing low and/or 200-day MA. Relief bounces are likely to be shorted at the 20-day MA.

The S&P experienced its second rejection of highs (the long upper candlestick wick) and resistance. Given the action in the Russell 2000 it may follow suit with a test of the 50-day MA on Friday. Note the sharp swing in relative strength in Large Caps favour - what money is out there from buyers will likely find its way here.

The Nasdaq undercut its 50-day MA as part of its losses. Like the S&P, it's looking at the February (and December) swing low. Of the indices, there is an opportunity for a bearish head-and-shoulders reversal. For this to be true, the current sell off would need to make it all the way back to February's support before a bounce to January's swing high. From there, the Nasdaq would return to February's lows and break below, setting up a measured move target of 3,650. But first steps first...

Given today's action, tomorrow is set for more of the same. A rapid sell off in the morning may offer a day trade bounce, but sellers are building pressure for a larger move to the 200-day MA. Despite the higher highs, selling volume has been stronger than buying volume over 2014; another indication a larger bear trend is developing.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

However, Small Caps took a big hit, dropping nearly 2% as buyers stayed away. Losses were quick to undercut the 50-day MA and the March swing low. Next up is the February swing low and/or 200-day MA. Relief bounces are likely to be shorted at the 20-day MA.

The S&P experienced its second rejection of highs (the long upper candlestick wick) and resistance. Given the action in the Russell 2000 it may follow suit with a test of the 50-day MA on Friday. Note the sharp swing in relative strength in Large Caps favour - what money is out there from buyers will likely find its way here.

The Nasdaq undercut its 50-day MA as part of its losses. Like the S&P, it's looking at the February (and December) swing low. Of the indices, there is an opportunity for a bearish head-and-shoulders reversal. For this to be true, the current sell off would need to make it all the way back to February's support before a bounce to January's swing high. From there, the Nasdaq would return to February's lows and break below, setting up a measured move target of 3,650. But first steps first...

Given today's action, tomorrow is set for more of the same. A rapid sell off in the morning may offer a day trade bounce, but sellers are building pressure for a larger move to the 200-day MA. Despite the higher highs, selling volume has been stronger than buying volume over 2014; another indication a larger bear trend is developing.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!