Daily Market Commentary: Breakout in S&P and Russell 2000

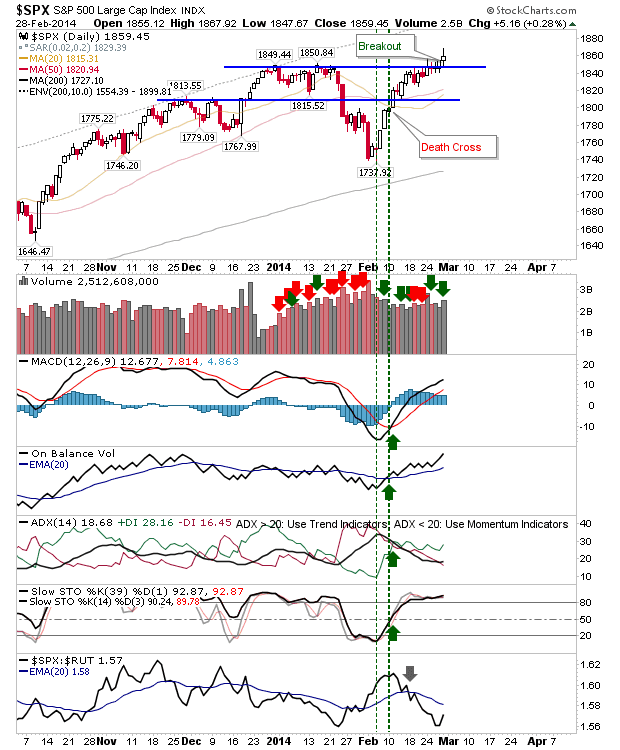

The real breakouts occurred in the S&P and Russell 2000 on Thursday, although it was bit anti-climatic to see these indices make the push given the Nasdaq and Nasdaq 100 had broken out in the weeks before. However, it's important as it now has all indices pushing new highs, even if the Russell 2000 did lose ground on Friday to threaten its nascent breakout.

The breakout in the S&P came in with higher volume accumulation, which suggests something more than the short covering which typically drives the early move. Technicals are good, but relative strength is sharply in favour of the Russell 2000 (and Nasdaq).

The Russell 2000 experienced a disappointing late afternoon loss which will have bulls nevry on Monday. Having finally taken out the January 'bull trap' it's a risk of creating another. A close below 1,182 would be an aggressive short with a stop on a close above 1,194.

But all of this is old news for the Nasdaq. Friday's selling registered as distribution, but it has lots of room to reach down to support. So Monday could see another down day, but bulls are likely to remain in control by the end of day.

Nasdaq breadth supported the rally, with barely a dip on Friday's sell off. For example, the Nasdaq Summation Index hasn't reached an overbought state.

Even the hypersensitive Percentage of Nasdaq Stocks above the 50-day MA barely change on Friday's sell off.

Markets are probably set up for losses on Monday, but shorts wouldn't want to get too comfortable as there is plenty of support on offer.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The breakout in the S&P came in with higher volume accumulation, which suggests something more than the short covering which typically drives the early move. Technicals are good, but relative strength is sharply in favour of the Russell 2000 (and Nasdaq).

The Russell 2000 experienced a disappointing late afternoon loss which will have bulls nevry on Monday. Having finally taken out the January 'bull trap' it's a risk of creating another. A close below 1,182 would be an aggressive short with a stop on a close above 1,194.

Nasdaq breadth supported the rally, with barely a dip on Friday's sell off. For example, the Nasdaq Summation Index hasn't reached an overbought state.

Even the hypersensitive Percentage of Nasdaq Stocks above the 50-day MA barely change on Friday's sell off.

Markets are probably set up for losses on Monday, but shorts wouldn't want to get too comfortable as there is plenty of support on offer.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!