Daily Market Commentary: The Dust Settles

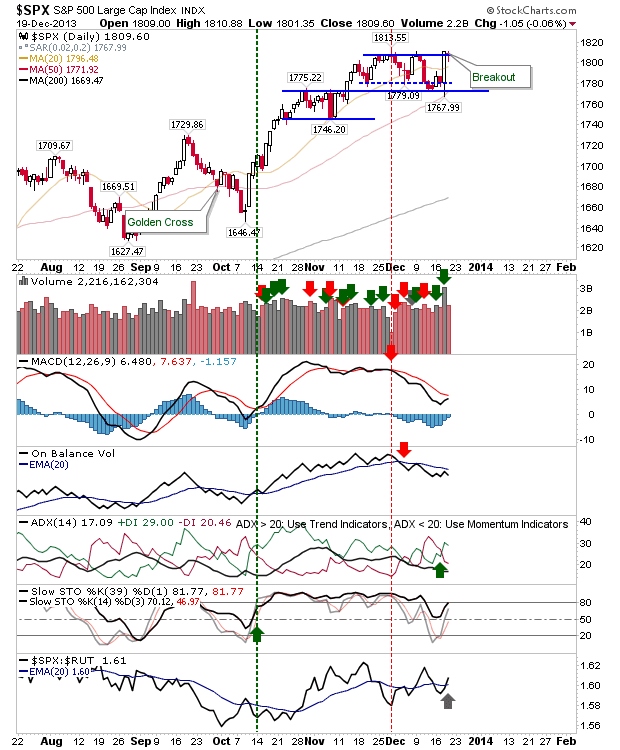

After Wednesday's turmoil, from breakdowns to breakouts, Thursday proved to be a quiet affair. If - as is likely to happen - the next few days stay quiet, then there could be a low risk long opportunity to take into the early part of 2014.

Wednesday's action would have rewarded traders looking at 50-day MAs: to cover shorts, and/or switch long side. The S&P having played to this nicely. Over the next few days, look for a fresh MACD trigger 'buy'

The Dow was the Large Cap winner. Strong technical swing back to bulls, with the 'bear trap' from October (along with the test of the 200-day MA) having offered those who took advantage, a nice end-of-year bonus.

The Nasdaq hasn't quite achieved the breakout goal. The relative swing to Large Caps does point to a flight to safety, suggesting the New Year rally may be limited to Blue Chip stocks, or at least, less risky Large Caps.

The breakout in the semiconductor index should help the Nasdaq and Nasdaq 100. There is a good MACD trigger 'buy' too, which knocked out a nascent bear shift before it had a chance to get started. Probably the best long trade of the bunch.

The Russell 2000 was perhaps the only disappointment. It did partake in the rally, bringing with it an improvement in technicals, and a breakout. But of the indices, it gave back the most on Thursday. It has been a token bullish response for Small Caps this Festivus season.

The rest of this year, and early next, look like it will belong to Large Caps. Although, bulls will likely find more reward in semiconductors than in any other index - at least risk is more palatable, with what should be a thick area of demand below 509.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Wednesday's action would have rewarded traders looking at 50-day MAs: to cover shorts, and/or switch long side. The S&P having played to this nicely. Over the next few days, look for a fresh MACD trigger 'buy'

The Dow was the Large Cap winner. Strong technical swing back to bulls, with the 'bear trap' from October (along with the test of the 200-day MA) having offered those who took advantage, a nice end-of-year bonus.

The Nasdaq hasn't quite achieved the breakout goal. The relative swing to Large Caps does point to a flight to safety, suggesting the New Year rally may be limited to Blue Chip stocks, or at least, less risky Large Caps.

The breakout in the semiconductor index should help the Nasdaq and Nasdaq 100. There is a good MACD trigger 'buy' too, which knocked out a nascent bear shift before it had a chance to get started. Probably the best long trade of the bunch.

The Russell 2000 was perhaps the only disappointment. It did partake in the rally, bringing with it an improvement in technicals, and a breakout. But of the indices, it gave back the most on Thursday. It has been a token bullish response for Small Caps this Festivus season.

The rest of this year, and early next, look like it will belong to Large Caps. Although, bulls will likely find more reward in semiconductors than in any other index - at least risk is more palatable, with what should be a thick area of demand below 509.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!