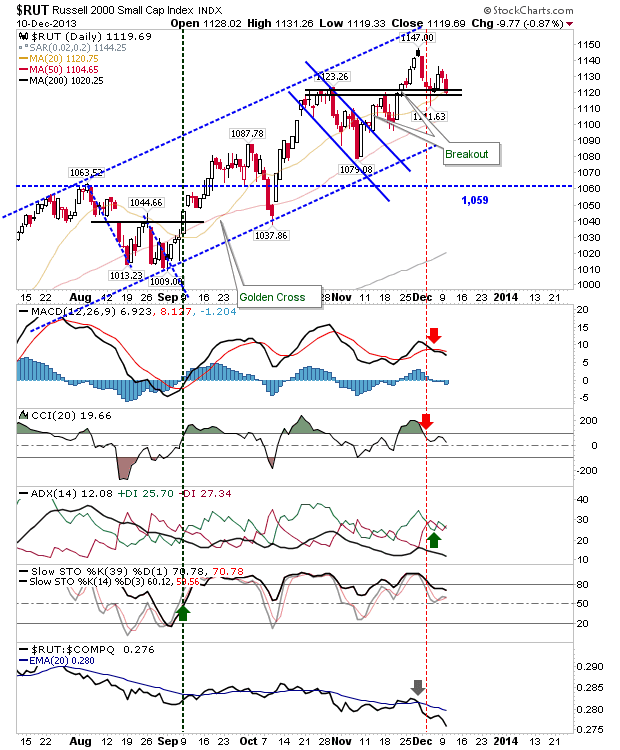

Daily Market Commentary: Small Caps Under Pressure

A near 1% loss for the day dropped the Russell 2000 back to support marked by the October swing high. Also here is the 20-day MA, another point to work as support. More worrying was the close near the low of the day, suggesting further losses are likely.

The Nasdaq was quieter, despite recording distribution volume. The tight range offers a swing trade opportunity, although whipsaw remains a concern.

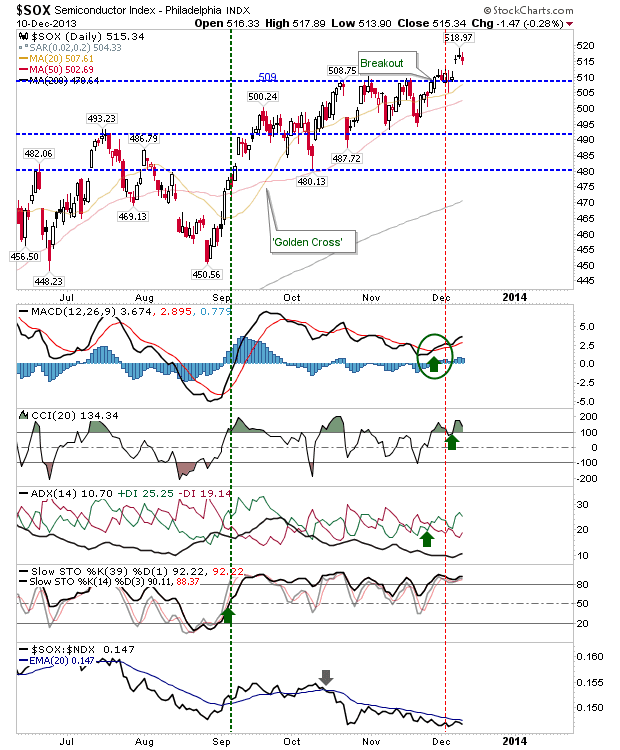

The semiconductor index is also holding its breakout which will help the Nasdaq and Nasdaq 100, and may give the swing play a more bullish bias.

Large Caps are still holding to the 'bear trap'.

It looks like the prior high retest in the Russell 2000 is about to fail, this will set up a shorting opportunity with a stop at the high of the bounce. Other indices hold to a bullish bias.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq was quieter, despite recording distribution volume. The tight range offers a swing trade opportunity, although whipsaw remains a concern.

The semiconductor index is also holding its breakout which will help the Nasdaq and Nasdaq 100, and may give the swing play a more bullish bias.

Large Caps are still holding to the 'bear trap'.

It looks like the prior high retest in the Russell 2000 is about to fail, this will set up a shorting opportunity with a stop at the high of the bounce. Other indices hold to a bullish bias.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!