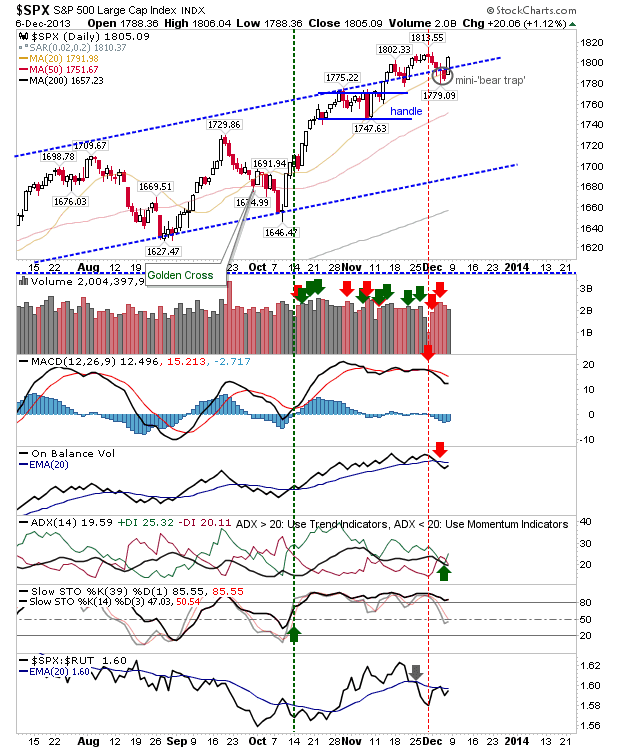

It was a valiant attempt by bulls to arrest the declines in Large Cap indices. It probably did enough to scare off shorts looking to attack Thursday's sell off, but volume wasn't exactly supporting the % gain.

The S&P was able to stick its nose back above the channel line and regain its 20-day MA in the process. It's a mini-'bear trap' for those who may have shorted the cut below the 20-day MA (which pushed the index back inside its channel). Technicals split bullish/bearish, although Friday's price action hands the ball back to the bulls.

The Nasdaq hasn't quite knocked out its 'bull trap' and Friday's finish had the look of a bearish 'hanging man'. Tech averages are the most bullish of the indices, so it will be interesting to see what Monday brings. Technicals for tech are all bullish. A gap down at the open would suggest Friday's surge had more enthusiasm than conviction from buyers.

However, the Nasdaq 100 did managed to mark a new all-time closing high. It remains the lead index for bulls and those whose preference is to be long the market (note large relative strength leap to the Russell 2000).

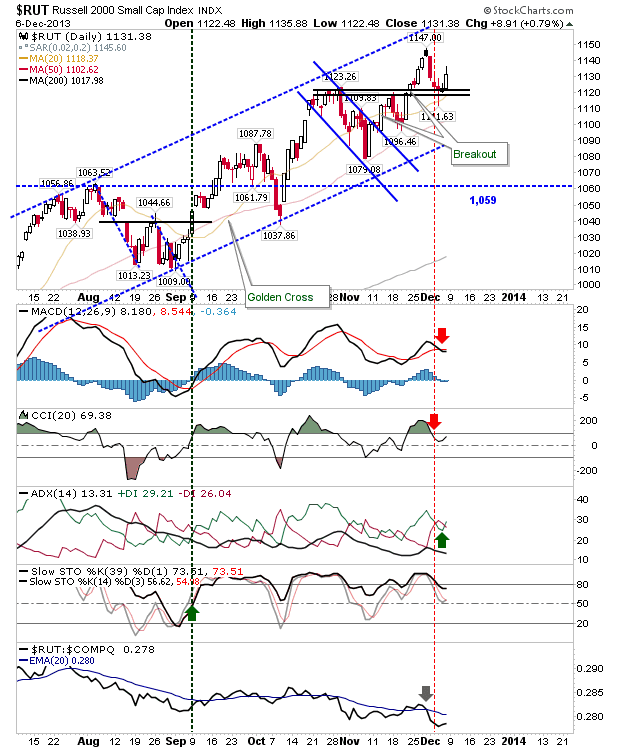

Small Caps offered the tailored bounce of support. Questionable whether it can make it back to challenge 1,147 given technicals are predominantly bearish, but not a short play as of Friday's close.

Shorts burned by Friday's rally can probably take a look at the Nasdaq. Anything above 4,070 would mark a short-cover. Buyers may be able to milk a little more from the Russell 2000, or look to take advantage of the 'bear traps' in Large Caps. However, it's not a great value market with lots of whipsaw potential to be found; for example, if Large Caps were to sell off back inside the channel, it would put their 'bear traps' under pressure, which isn't normally the case for traps to be found wanting so quickly. 'Bear traps' work best in oversold markets - but this isn't the case for either Dow or S&P).

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!