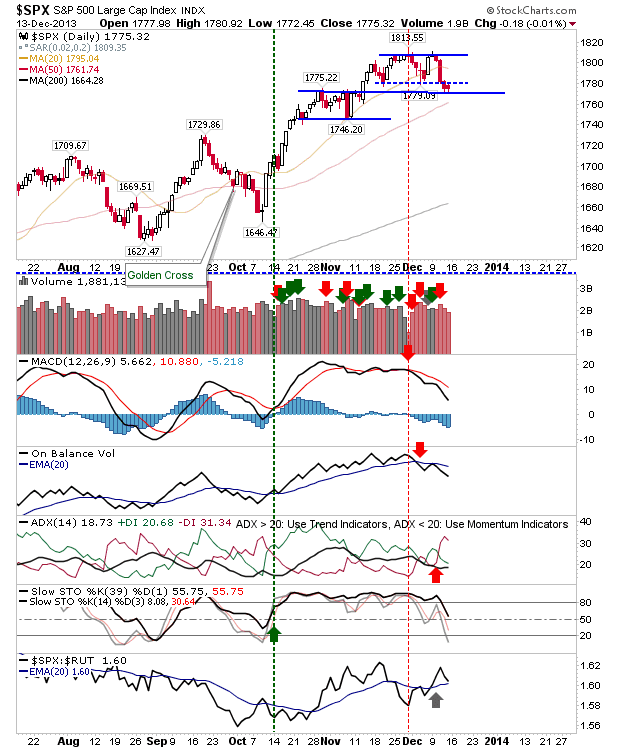

The S&P showed it best: a bright open, which failed to catch, but didn't evolve into losses. The S&P didn't break support and volume dropped. For Monday, it's still a potential bounce play, offering relatively low risk given the presence of support. Those who want to give a long play more room can use the 50-day MA as the marker for a stop - BUT - a break of this support would generate a short play with a stop above 4,018. The one thing a break of support brings is a likely one-day, rapid drop to the 50-day MA, which would leave longs fretting; hoping the 50-day MA sticks as support.

The Nasdaq was similar to the S&P, except it finished a little higher than lower. It too has support to work off, although it hasn't yet managed to regain its 20-day MA. There was an On-Balance-Volume 'buy' which equates to a 'bear trap' in this indicator. It still has the 'feel' of a short play with the 50-day MA the downside target.

The semiconductor index did find support at the 50-day MA despite its losses. Technicals are primarily weak and weakening, but there may be enough for a bounce on Monday. This will help bulls in the Nasdaq, so it will be an interesting battle between a more bearish Nasdaq and a hint of bullish semiconductor index. Note, the semiconductor index has held every test of its 50-day MA going back to August.

The Russell 2000 attempted a rally, but got caught by its 50-day MA. Technicals are net bearish, which isn't good news for bulls. The index is still trading inside its bullish channel, but it looks ready to break again which, if it does, will mark a far more significant bearish turn than the one day loss would typically mean.

Overall, it's a clear market for long profit taking, with shorts having the short term edge. The bulls have the longer trend, but it doesn't have the feel of a bullish market. If this offers itself as as swing low for longs it's only because of its proximity to the longer bullish trend, because technicals and price action don't say 'buy'.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!