Daily Market Commentary: Mixed Day

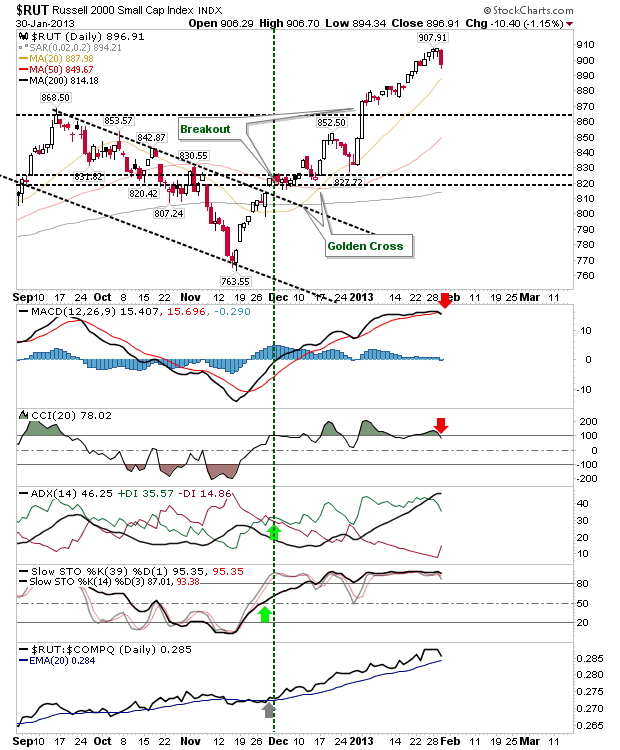

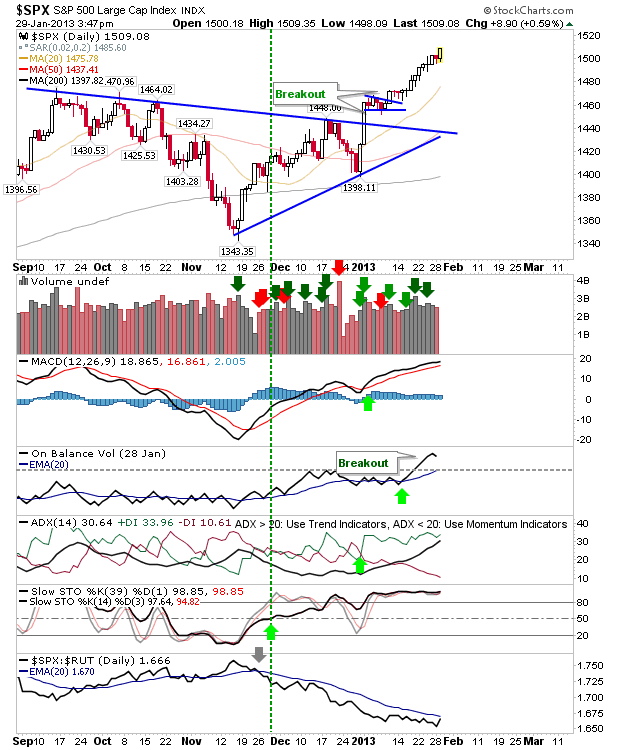

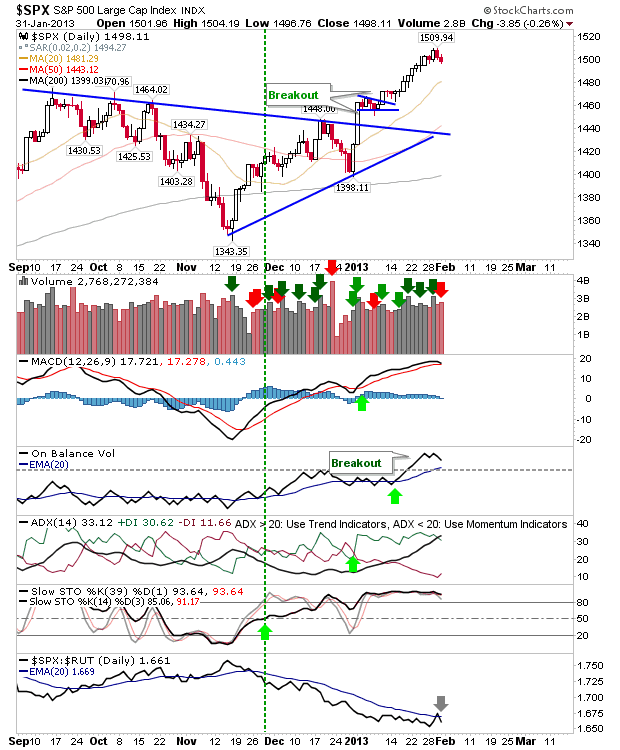

An odd day for the markets with a mix of gains (Russell 2000) and losses (anything else!). Volume climbed to register distribution for the Nasdaq, Nasdaq 100 and S&P, but given the degree of loss it's more like churning than hard defined selling. The S&P sharply reversed its relative gain against the Russell 2000, but is close to a MACD trigger 'sell'.