Weekly Market Commentary: Little Change on Week

Markets had a bit of a roller coaster week on continued shenanigans in Europe, although the net effect was to see little change on the week.

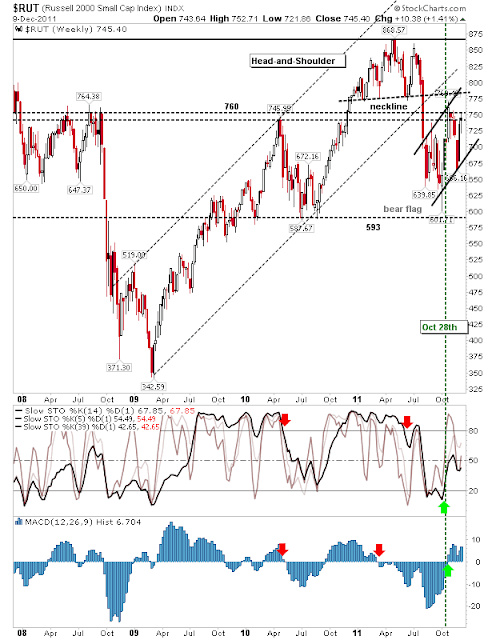

The Russell 2000 got close to 760 resistance as technicals improved. The index continues to trade inside the potential 'bear flag'.

The Dow was able to push a little more given resistance is a couple hundred points away - namely declining resistance from the early 2011 swing highs..

The S&P also offers room to the upside. But...

S&P market breadth exhibited a 'bull trap', which suggests lower prices!

Despite the 'bull trap' in the NYSE Summation Index the rising price trend remains dominant for the S&P and others. Look for another week of gains until declining resistance created by April and July swing highs becomes more of an issue.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Russell 2000 got close to 760 resistance as technicals improved. The index continues to trade inside the potential 'bear flag'.

The Dow was able to push a little more given resistance is a couple hundred points away - namely declining resistance from the early 2011 swing highs..

The S&P also offers room to the upside. But...

S&P market breadth exhibited a 'bull trap', which suggests lower prices!

Despite the 'bull trap' in the NYSE Summation Index the rising price trend remains dominant for the S&P and others. Look for another week of gains until declining resistance created by April and July swing highs becomes more of an issue.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!