Daily Market Commentary: Higher Volume Accumulation

Although I missed yesterday's trading action, today's buying created a higher reaction low which keeps the basis of the Santa rally intact. Positive housing data was offered as a reason for the buying but this was the second day in three where markets enjoyed higher volume accumulation (well, the Dow was an exception - but not really!)

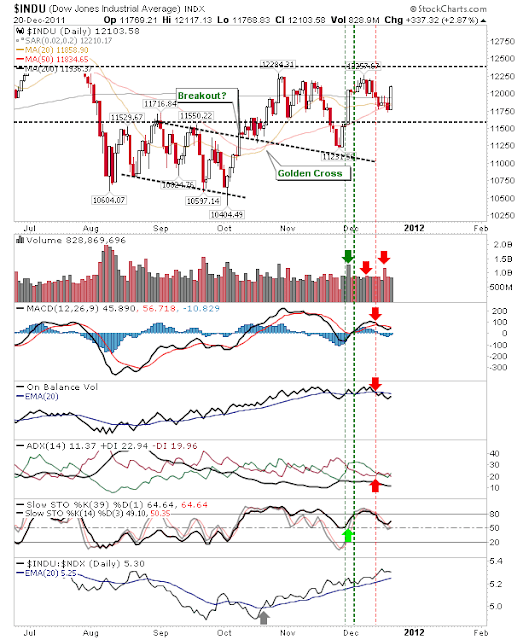

The Dow is in the best shape of the indices. Today's buying took it from below 20-day, 50-day and 200-day MAs to above all three. A close above 12,250 will be enough to make new closing high for the October rally.

The S&P hasn't quite enjoyed the same degree of buying as the Dow. While it regained the 20-day and 50-day MAs, it hasn't yet challenged its 200-day MA. Declining resistance connecting October, November and December highs hasn't yet been breached. And just above declining resistance is converged 1,260 and 200-day MA resistance.

The Nasdaq has been consistently underperforming the S&P since the middle of October and while it gained more than the S&P today, it's still a couple days away from regaining a leadership rule. First step is to clear 2,616 resistance before it can challenge the 200-day MA currently at 2,663.

The Russell 2000 is pressuring declining resistance from October after a strong 4% day; break this and the 200-day MA at 764 is the next target. Today's rally keeps it ahead of the Nasdaq and S&P despite trading below its 200-day MA.

Confirmed reaction lows in August, October and November have all kicked off with a rally much like today. Santa Rally lovers will be particularly pleased to see the strength of buying as occurred today. The prior loss of 20-day and 50-day MAs will have been attractive entry points for short positions, but covering these positions - fueling additional buying - will be the order of the day.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Dow is in the best shape of the indices. Today's buying took it from below 20-day, 50-day and 200-day MAs to above all three. A close above 12,250 will be enough to make new closing high for the October rally.

The S&P hasn't quite enjoyed the same degree of buying as the Dow. While it regained the 20-day and 50-day MAs, it hasn't yet challenged its 200-day MA. Declining resistance connecting October, November and December highs hasn't yet been breached. And just above declining resistance is converged 1,260 and 200-day MA resistance.

The Nasdaq has been consistently underperforming the S&P since the middle of October and while it gained more than the S&P today, it's still a couple days away from regaining a leadership rule. First step is to clear 2,616 resistance before it can challenge the 200-day MA currently at 2,663.

The Russell 2000 is pressuring declining resistance from October after a strong 4% day; break this and the 200-day MA at 764 is the next target. Today's rally keeps it ahead of the Nasdaq and S&P despite trading below its 200-day MA.

Confirmed reaction lows in August, October and November have all kicked off with a rally much like today. Santa Rally lovers will be particularly pleased to see the strength of buying as occurred today. The prior loss of 20-day and 50-day MAs will have been attractive entry points for short positions, but covering these positions - fueling additional buying - will be the order of the day.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!