Daily Market Commentary: Decent Recovery Into Market Close

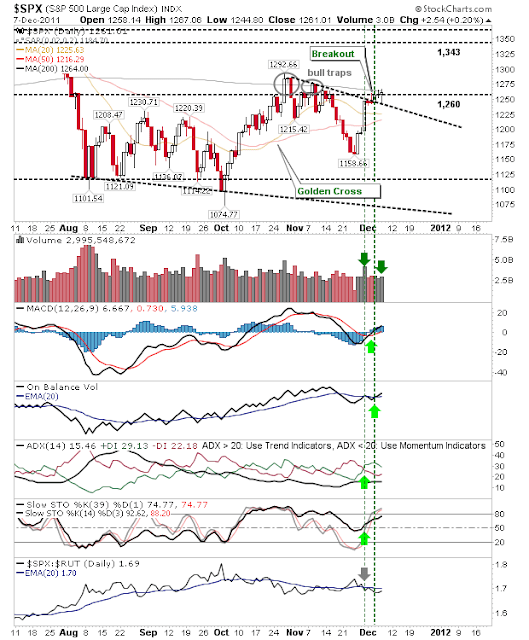

Morning action had suggested 200-day MAs had finally proven to be a step too far for the indices, but a late day recovery placed the pressure back on these key moving averages. Certainly, there is strong indication 200-day MAs will be broken to the upside.

The S&P found support at the back test of declining resistance turned support. Volume climbed to register an accumulation day as the index also finished above 1,260 support.

The Nasdaq is similarly poised, although there is a far greater level of tension between rising 50-day MA support and falling 200-day MA resistance; look for this to sharply resolve one way or the other - should be a good trade (likely to the upside).

The Russell 2000 is the loosest of the indices in that it's neither near 200-day MA resistance or 50-day MA support. Therefore it may lag in response when the break finally comes in either the Nasdaq or S&P.

For tomorrow, look to Futures with the S&P likely to lead the 200-day MA break, but the Nasdaq perhaps more likely to benefit from a break.

-----------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P found support at the back test of declining resistance turned support. Volume climbed to register an accumulation day as the index also finished above 1,260 support.

The Nasdaq is similarly poised, although there is a far greater level of tension between rising 50-day MA support and falling 200-day MA resistance; look for this to sharply resolve one way or the other - should be a good trade (likely to the upside).

The Russell 2000 is the loosest of the indices in that it's neither near 200-day MA resistance or 50-day MA support. Therefore it may lag in response when the break finally comes in either the Nasdaq or S&P.

For tomorrow, look to Futures with the S&P likely to lead the 200-day MA break, but the Nasdaq perhaps more likely to benefit from a break.

-----------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!