Daily Market Commentary: Little Change

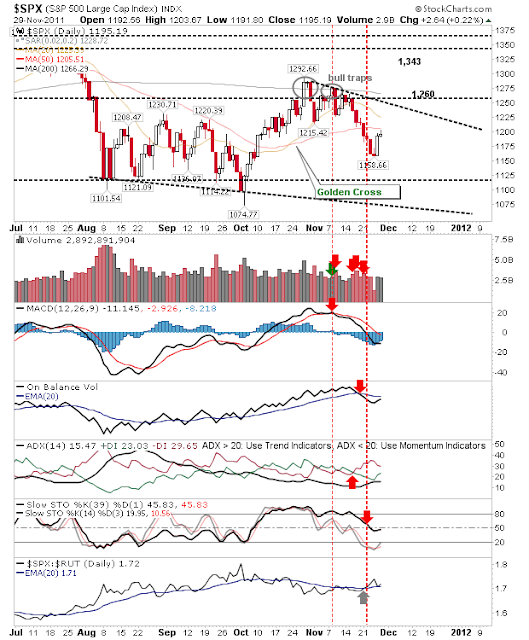

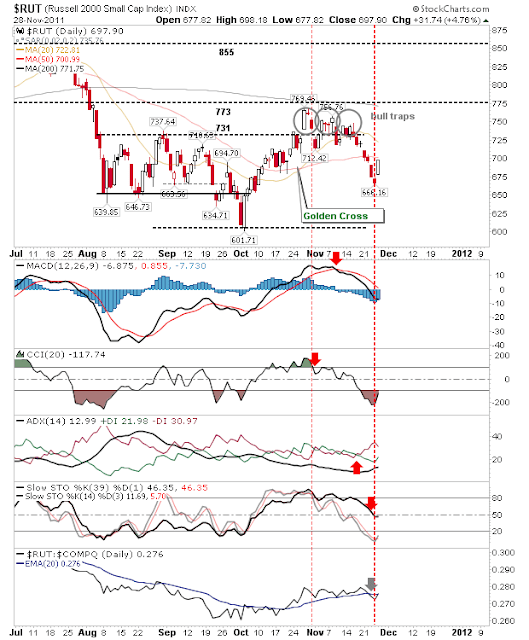

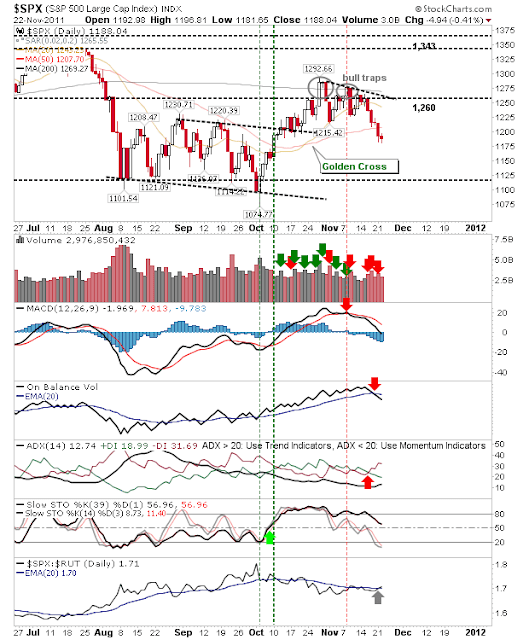

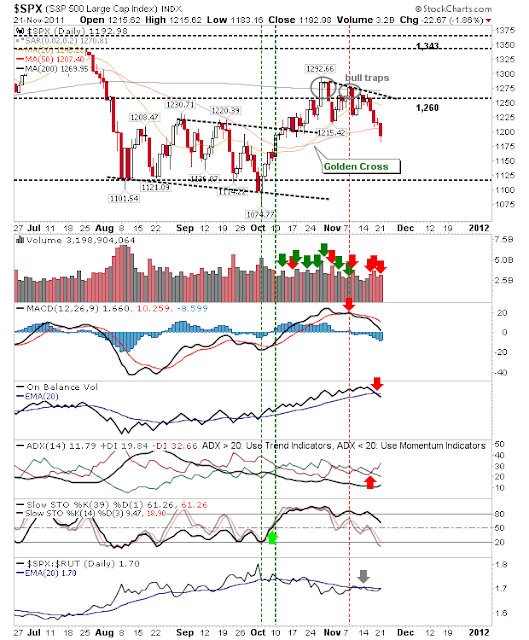

Not a whole lot you can say about today. After yesterday's whopper day it was always going to be tough to get a repeat of the buying, but the good news is it didn't give up any of those gains either. The S&P is honoring declining resistance (from the 'bull trap' highs). On-balance-volume switched back to a 'sell' trigger. The Nasdaq was able to push above 2,616, bringing with it a 'buy' trigger in the +DI/-DI and Stochastics. Nasdaq Breadth also improved, although the recovery is not from an oversold position, this may shorten the length of the bounce. While the Nasdaq 100 was able to push above its 200-day MA (not to mention its 20-day and 50-day MAs too), but is still contained by 2,320 resistance. Finally, the Russell 2000 stays pegged to resistance aswell. Because of the minor losses the indices are well placed to push higher and break resistance. Given the influence of European troubles on the U.S. market, futures shou...