Daily Market Commentary: Bears Add Misery

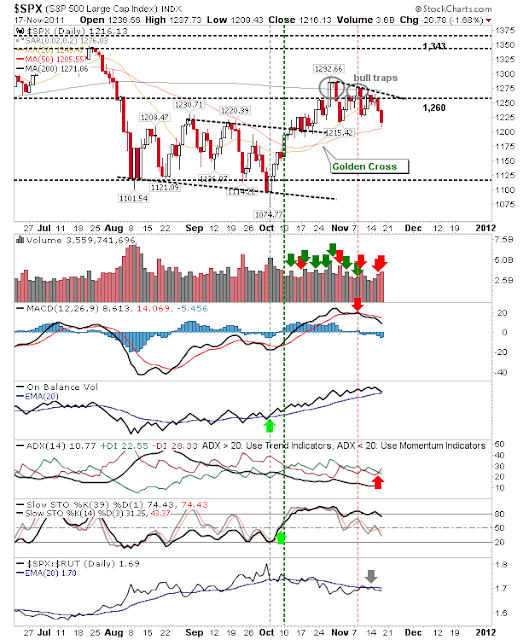

The initial slash cut was made Wednesday, but bulls were unable to stem the bleeding as further losses mounted today. Volume climbed to bring a second distribution day in a row; the last time this occurred was in September (and was followed by a 3-day rally). The main damage done today was the push to the low end (or out-of) sideways consolidations in play. Bulls still have support to work with, which in many cases are 50-day MAs - but they are running out of options to prevent a retest of October lows.

The S&P was one of the indices to finish on its 50-day MA. Technical weakness was marked by the bear cross between +DI/-DI, although ADX does not (yet) suggest a bear trend is beginning.

The main damage done today was to the Nasdaq 100. An ugly break of 2,320 support on an over 2% loss also saw breaks of the 200-day and 50-day MAs. Thursday's selling even saw a close below the October swing low. To add to the misery, on-balance-volume switched to a 'sell' trigger.

The Nasdaq was also attacked, although the damage was not as severe as it was in the Nasdaq 100. The Nasdaq didn't undercut the October swing low and it may have done enough to remain at 50-day MA support. Technicals aren't as weak as the Nasdaq 100 either.

Contributing to the Tech collapse was the near 4% loss in the semiconductor index. The loss posted a third bull trap off 385 support (now resistance, along with 381), but did finish above its 50-day MA.

Nasdaq breadth also looks to have peaked with the Summation Index and Percentage of Nasdaq Stocks above the 50-day MA exhibiting rolling tops on increasing technical weakness.

To complete the set, the Russell 2000 dipped below 731 support in a move away from its 20-day MA. Luckily, the 50-day MA is still a day's selling away and today's selloff was mild compared to that of the Nasdaq and Nasdaq 100.

There is probably enough demand after two days of selling to see some form of relief bounce work off key moving averages. The Nasdaq and Nasdaq 100 have the most ground to make up so they might offer the best day trade potential from tomorrow's open (better value may be achieved premarket if there is any follow through selling). The Russell 2000 offers the best value for longer term holders, although if it was to break below its 50-day MA it would be looking at a retest of the early October low at 601.

---------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P was one of the indices to finish on its 50-day MA. Technical weakness was marked by the bear cross between +DI/-DI, although ADX does not (yet) suggest a bear trend is beginning.

The main damage done today was to the Nasdaq 100. An ugly break of 2,320 support on an over 2% loss also saw breaks of the 200-day and 50-day MAs. Thursday's selling even saw a close below the October swing low. To add to the misery, on-balance-volume switched to a 'sell' trigger.

The Nasdaq was also attacked, although the damage was not as severe as it was in the Nasdaq 100. The Nasdaq didn't undercut the October swing low and it may have done enough to remain at 50-day MA support. Technicals aren't as weak as the Nasdaq 100 either.

Contributing to the Tech collapse was the near 4% loss in the semiconductor index. The loss posted a third bull trap off 385 support (now resistance, along with 381), but did finish above its 50-day MA.

Nasdaq breadth also looks to have peaked with the Summation Index and Percentage of Nasdaq Stocks above the 50-day MA exhibiting rolling tops on increasing technical weakness.

To complete the set, the Russell 2000 dipped below 731 support in a move away from its 20-day MA. Luckily, the 50-day MA is still a day's selling away and today's selloff was mild compared to that of the Nasdaq and Nasdaq 100.

There is probably enough demand after two days of selling to see some form of relief bounce work off key moving averages. The Nasdaq and Nasdaq 100 have the most ground to make up so they might offer the best day trade potential from tomorrow's open (better value may be achieved premarket if there is any follow through selling). The Russell 2000 offers the best value for longer term holders, although if it was to break below its 50-day MA it would be looking at a retest of the early October low at 601.

---------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!