Daily Market Commentary: Day of Contrasts

I had looked to 'Black Friday' as the day we would see the big one-day rally. Instead, Monday (or more precisely, pre-market Monday) was when markets booked their gain. Unfortunately, the gains came at a cost.

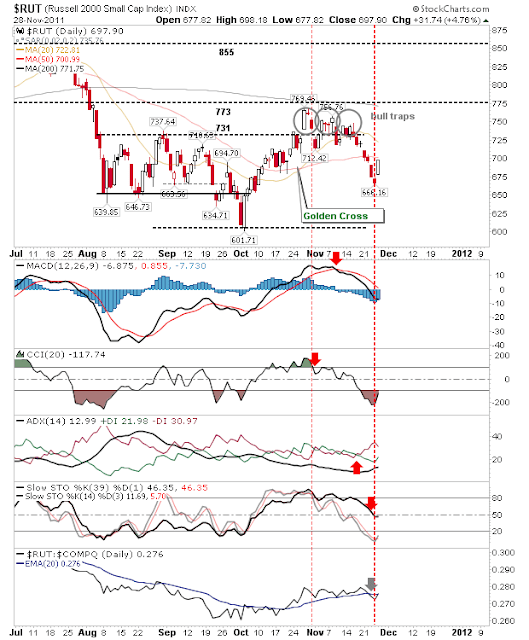

First up was the Russell 2000. It posted nearly a 5% gain, but it wasn't enough to recover a net bearish turn in technicals. Monday's rally finished just shy of its 50-day MA. The tricky part is the current trading inside August-September congestion. A break of the 50-day MA tomorrow sets up a move to the 20-day MA at 722.81.

The S&P also experienced what looks to be a 'dead cat bounce'. Volume was down with the 50-day MA nearby to provide resistance. As with all the lead indices, the August-October congestion range keeps things tricky; although 'bull traps' typically retrace the entire move - and then some.

The Nasdaq is also stuck in the Aug-Oct congestion zone. But the concern is not the index, but supporting market breadth indicators.

The Nasdaq Bullish Percents turned net bearish:

Along with the Nasdaq Summation Index. The Summation Index is closer to overbought than oversold suggesting there are more declines to come.

And the already bearish Percentage of Nasdaq Stocks above 50-day MA. Although the latter is close to oversold.

So while today's gains were impressive there are still significant bearish influencing factors. The first challenge will be 50-day MAs and soon after that, 20-day MAs; should markets trade sideways from here then the next challenge may be fast falling 20-day MAs.

---------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

First up was the Russell 2000. It posted nearly a 5% gain, but it wasn't enough to recover a net bearish turn in technicals. Monday's rally finished just shy of its 50-day MA. The tricky part is the current trading inside August-September congestion. A break of the 50-day MA tomorrow sets up a move to the 20-day MA at 722.81.

The S&P also experienced what looks to be a 'dead cat bounce'. Volume was down with the 50-day MA nearby to provide resistance. As with all the lead indices, the August-October congestion range keeps things tricky; although 'bull traps' typically retrace the entire move - and then some.

The Nasdaq is also stuck in the Aug-Oct congestion zone. But the concern is not the index, but supporting market breadth indicators.

The Nasdaq Bullish Percents turned net bearish:

Along with the Nasdaq Summation Index. The Summation Index is closer to overbought than oversold suggesting there are more declines to come.

And the already bearish Percentage of Nasdaq Stocks above 50-day MA. Although the latter is close to oversold.

So while today's gains were impressive there are still significant bearish influencing factors. The first challenge will be 50-day MAs and soon after that, 20-day MAs; should markets trade sideways from here then the next challenge may be fast falling 20-day MAs.

---------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!