Daily Market Commentary: Higher Volume Accumulation

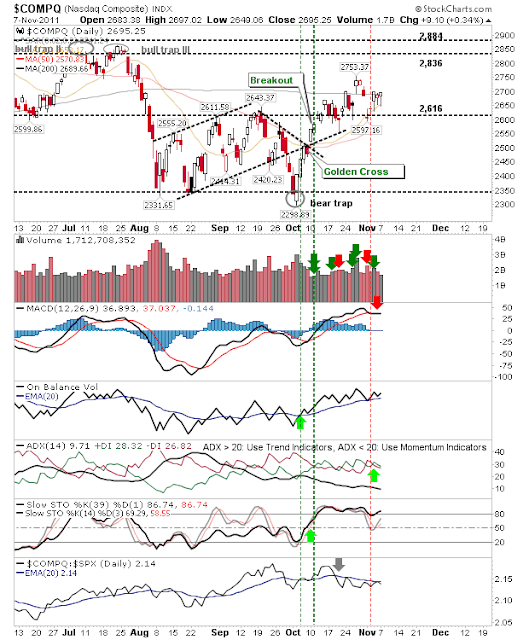

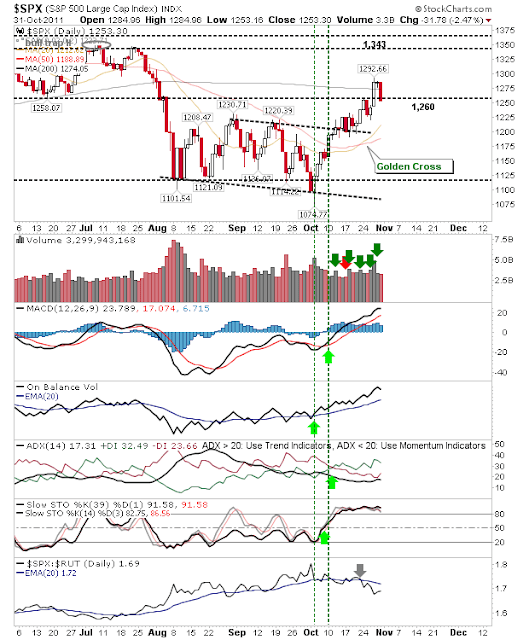

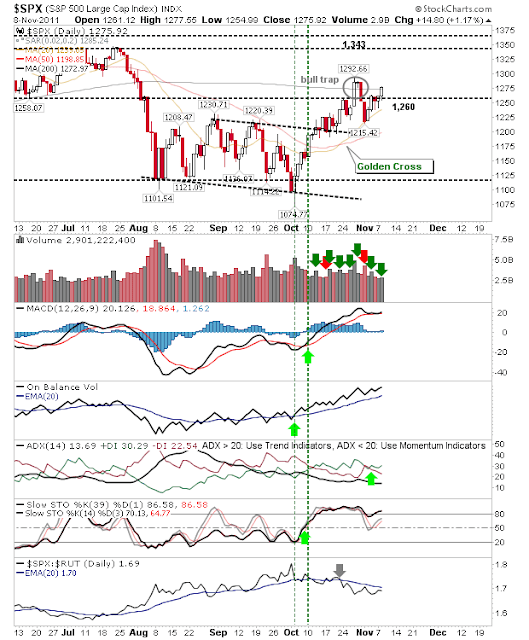

Another good day for the indices leaves things a little uncertain for tomorrow. The last swing highs are fast approaching but these will add supply on further gains. The S&P closed above its 200-day MA, maintaining 1,260 support. The Nasdaq edged over its 200-day MA and is only a day away from testing the October swing high at 2,753. The Russell 2000 defended 731 support. Meanwhile, the 'bull trap' which played on the initial break of 731 is under threat of negation. Tomorrow is a little trickier to play. The highs of 'bull traps' are the next challenge but whether there is the demand to see this happen tomorrow remains to be seen. The good news is bulls are in firm control of the market. ------- Follow Me on Twitter Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com . I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can al...