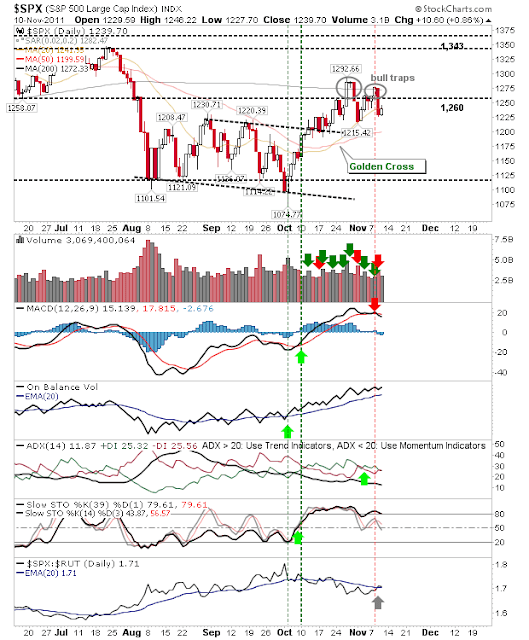

The real damage was done yesterday (in my absence!), but the weakness triggered by the selling was not relieved by today's weak buying; today's volume was sharply down on yesterday's selling. Technical deterioration, led mostly by MACD trigger 'sells', added to indices troubles.

The S&P posted the second of two 'bull traps' as the index struggled in its second challenge of its 200-day MA. On the plus front, the index started to outperform the Russell 2000 (Small Caps). While this is good news for the S&P it's not good for the long term prospects of this rally. A sustainable rally needs money flow to speculative Small Cap stocks - not defensive Large Cap issues.

The Nasdaq was similarly afflicted with a MACD trigger 'sell' and a 'sell' in the Directional Movement index. On the plus front, Thursday's close held 2,616 support which has been support since early October. While indices are wavering in their technical health, the Nasdaq remains predominantly bullish.

It's a similar story for the Nasdaq 100. Today's selling tested and held 2,320 support, plus its 200-day MA at 2,298. The 20-day and 50-day MAs are also nearby to lend support. Ironically, this index was one of the first to trigger a MACD 'sell'.

The semiconductor index has flashed a second 'bull trap'. This needs to be nixed quickly if it's not to strengthen into something more protracted.

Nasdaq breath continues to weaken. Bullish Percents now join the Percentage of Nasdaq Stocks above the 50-day MA in rolling negative.

And just to complete the list, the Russell 2000 also finished with a second 'bull trap'. Today's buying wasn't enough to challenge the newly formed 'bull trap', nor was it enough to take the index above its 20-day MA. Like the S&P, it will have its work cut out for it tomorrow.

Bulls need to do something off Friday's open; it's important bears are prevented from building momentum after today's attempted recovery. If bears can take out today's lows it will offer an easy opportunity to press their advantage. Bulls will want to push the indices back inside the 'bull traps' and keep them there until the market closes.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!