Daily Market Commentary: Accumulation or Churning

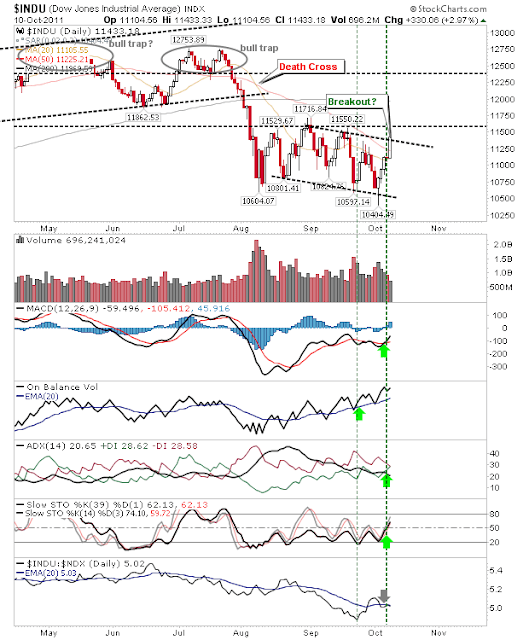

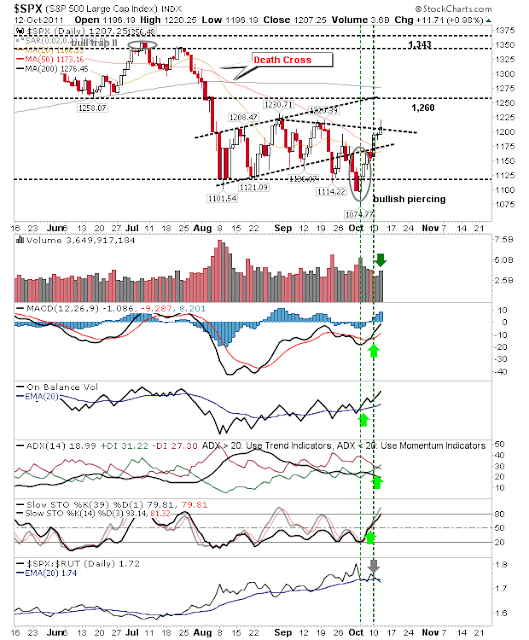

Bulls went to town and added another day of gains to this October rally. However, bulls were unable to push on from opening gaps. Volume climbed which may either rank as accumulation (because of higher prices) or churning (because markets closed at or below their opening levels). The S&P had managed to clear declining resistance in early trading but sellers returned to bring it back below resistance. Technicals remain net bullish while relative strength shifted back to the Russell 2000. The Nasdaq posted a 'shooting star' doji just below 2,616 resistance. This is likely to be a point where sellers take over for the next couple of days. The Russell 2000 pushed above its 50-day MA but technicals haven't done enough to turn net bullish (yet). However, Small Caps have taken a leadership role over Tech (and Large Caps). The index is back inside the quagmire of the prior consolidation so it's likely to get scrappy from here. The 200-day MA is the logical upsid...