Weekly Market Commentary: Weeky 'Bear Traps'

A solid week for indices saw market breadth take another significant step higher. 'Bear traps' on the daily timeframe extended in to the weeklies. It will be important indices push on to challenge the next level of resistance and confirm a swing low, a swing low to build into a "Santa Rally" later on in the year.

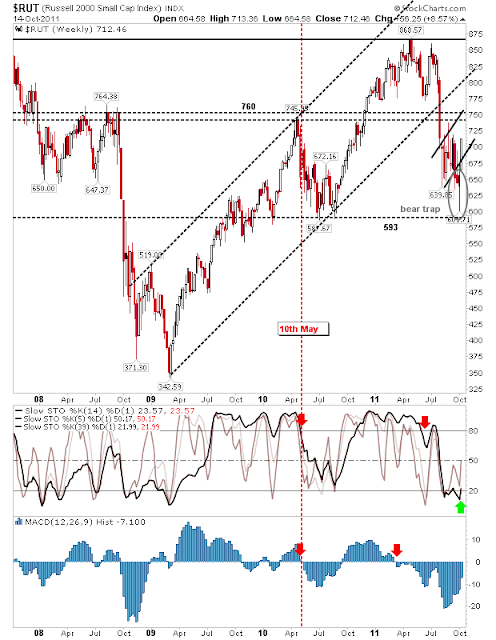

Small Caps enjoyed the best of the week; the Russell 2000 finished the week up nearly 9%. The index is back inside the prior 'bear flag', but this should really push on to challenge 760 resistance (which so happens to be former 'flag' resistance).

The Nasdaq finished the week at the top of its former 'bear flag' (now negated by the 'bear trap'). Technicals continue to improve with an on-balance-volume 'buy' trigger and a MACD trigger 'buy' likely by the end of next week. The next challenge is around 2,800 resistance.

Helping the Nasdaq is a fresh technical 'buy' in the Nasdaq Summation Index, following that of the Percentage of Nasdaq Stocks above the 50-day MA last week.

A similar 'buy' trigger occurred in the NYSE Summation index too.

Which will help the S&P build on its break of 1,209 (again - with a 'bear trap' to support the counter move higher).

Also helping the S&P is the technical 'buy' trigger in the S&P Bullish Percents. At 55% there are now more S&P stocks on point-n-figure buy triggers than not.

For next week it might be the turn of Large Caps to do the heavy lifting as relative strength shifts to more defensive issues. Tech averages can look to continue their good form. Small Caps enjoyed a good week but have more ground to make up which may keep them out of favour.

As rally strength on the daily timeframe build out into the weekly one it will help build the foundation for a longer rally. The seasonal weak period is set to end soon which will provide another tick in the bull column. Buyers hold the edge.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Small Caps enjoyed the best of the week; the Russell 2000 finished the week up nearly 9%. The index is back inside the prior 'bear flag', but this should really push on to challenge 760 resistance (which so happens to be former 'flag' resistance).

The Nasdaq finished the week at the top of its former 'bear flag' (now negated by the 'bear trap'). Technicals continue to improve with an on-balance-volume 'buy' trigger and a MACD trigger 'buy' likely by the end of next week. The next challenge is around 2,800 resistance.

Helping the Nasdaq is a fresh technical 'buy' in the Nasdaq Summation Index, following that of the Percentage of Nasdaq Stocks above the 50-day MA last week.

A similar 'buy' trigger occurred in the NYSE Summation index too.

Which will help the S&P build on its break of 1,209 (again - with a 'bear trap' to support the counter move higher).

Also helping the S&P is the technical 'buy' trigger in the S&P Bullish Percents. At 55% there are now more S&P stocks on point-n-figure buy triggers than not.

For next week it might be the turn of Large Caps to do the heavy lifting as relative strength shifts to more defensive issues. Tech averages can look to continue their good form. Small Caps enjoyed a good week but have more ground to make up which may keep them out of favour.

As rally strength on the daily timeframe build out into the weekly one it will help build the foundation for a longer rally. The seasonal weak period is set to end soon which will provide another tick in the bull column. Buyers hold the edge.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!