Daily Market Commentary: Modest Loss

Yesterday's gains were a bit of a surprise given Monday's selloff in an overbought market. Today was a fresh opportunity for bears to launch another attack, but in the end a late day sell off was the best they could do to push markets lower. Volume was also lighter. Tomorrow is another opportunity for bears to create an advantage with indices lurking close to support.

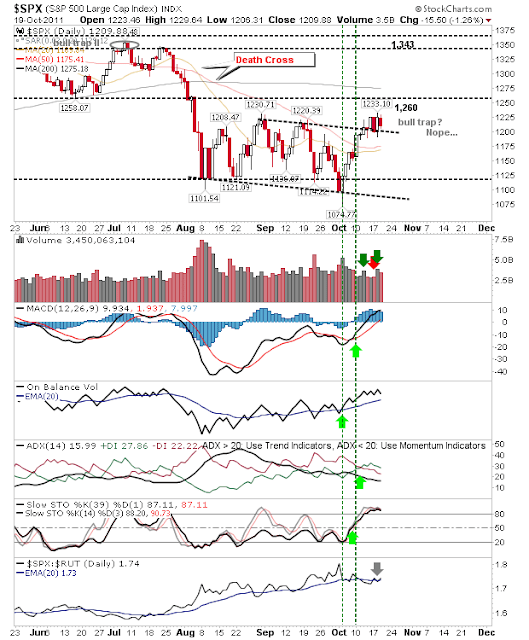

The S&P is holding above channel resistance-turned-support. Nearest resistance sits at 1,260 and support at a converging (and rising) 20-day and 50-day MAs. Today's selling should lead to a test of these MAs before bulls show their hand.

The Nasdaq has support at 2,616 with today's close was below that, but there is probably enough mojo here to consider it at support. A 'bullish flag' may be taking shape, although the volume pattern doesn't quite fit. If true, tomorrow or Friday should see a gap higher followed by a strong day.

The Russell 2000 has been caught in the middle. Stuck in a tight trading range within a larger consolidation, holding above its 50-day MA but not enjoying sufficient demand to see it challenge 731 resistance. The 50-day MA has started to tick higher which suggests bulls have the edge. But bulls don't have much wiggle room given the proximity of today's close to the 50-day MA (@684). Look to play it tight to the longside assuming no gap below the 50-day MA.

Tomorrow's open is likely to dictate terms. Any gap down will likely push indices below reasonable support and/or 50-day MAs which will give the edge to bears. A flat open might give bulls an opportunity with a tight stop.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is holding above channel resistance-turned-support. Nearest resistance sits at 1,260 and support at a converging (and rising) 20-day and 50-day MAs. Today's selling should lead to a test of these MAs before bulls show their hand.

The Nasdaq has support at 2,616 with today's close was below that, but there is probably enough mojo here to consider it at support. A 'bullish flag' may be taking shape, although the volume pattern doesn't quite fit. If true, tomorrow or Friday should see a gap higher followed by a strong day.

The Russell 2000 has been caught in the middle. Stuck in a tight trading range within a larger consolidation, holding above its 50-day MA but not enjoying sufficient demand to see it challenge 731 resistance. The 50-day MA has started to tick higher which suggests bulls have the edge. But bulls don't have much wiggle room given the proximity of today's close to the 50-day MA (@684). Look to play it tight to the longside assuming no gap below the 50-day MA.

Tomorrow's open is likely to dictate terms. Any gap down will likely push indices below reasonable support and/or 50-day MAs which will give the edge to bears. A flat open might give bulls an opportunity with a tight stop.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!