Daily Market Commentary: Higher Volume Accumulation

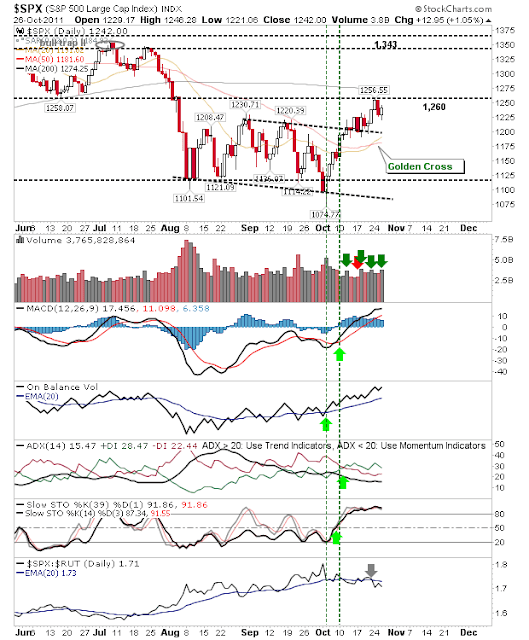

Bulls were again able to prevent a bearish follow through on prior day's selling. Also working in bulls favour was the higher volume accumulation.

The S&P is well prepared to mount a new challenge on 1,260 resistance and push on towards the 200-day MA. Technicals continue to strengthen in support of the rally.

The Nasdaq enjoyed an intraday spike low into 2,616 support. This sets up an opportunity for a new challenge on 200-day MA resistance. The next break of the 200-day MA may be the one which sticks.

Nasdaq Market Breadth continued its improvement - the Summation Index has enjoyed smooth sailing with market reversals typical at 0 or higher; it closed today at -85.

While the semiconductors look set to break 381 resistance

And the Russell 2000 may yet negate Tuesday's 'bull trap'. Today's rally left the index just below 731 resistance.

The likelihood of the week finishing as I had expected it to start (i.e. weak) will depend on whether resistance breaks tomorrow. Monday offered the initial opportunities for resistance breaks which were undone by Tuesday's selling. Wednesday saw markets recover to leave them nicely primed to break resistance for a second time. However, bears will eventually seize one of the opportunities their offered. Should tomorrow close down then Friday could see such opportunities seized with pushes down to 20-day MAs. First hour of Thursday's trading will be interesting.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is well prepared to mount a new challenge on 1,260 resistance and push on towards the 200-day MA. Technicals continue to strengthen in support of the rally.

The Nasdaq enjoyed an intraday spike low into 2,616 support. This sets up an opportunity for a new challenge on 200-day MA resistance. The next break of the 200-day MA may be the one which sticks.

Nasdaq Market Breadth continued its improvement - the Summation Index has enjoyed smooth sailing with market reversals typical at 0 or higher; it closed today at -85.

While the semiconductors look set to break 381 resistance

And the Russell 2000 may yet negate Tuesday's 'bull trap'. Today's rally left the index just below 731 resistance.

The likelihood of the week finishing as I had expected it to start (i.e. weak) will depend on whether resistance breaks tomorrow. Monday offered the initial opportunities for resistance breaks which were undone by Tuesday's selling. Wednesday saw markets recover to leave them nicely primed to break resistance for a second time. However, bears will eventually seize one of the opportunities their offered. Should tomorrow close down then Friday could see such opportunities seized with pushes down to 20-day MAs. First hour of Thursday's trading will be interesting.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!