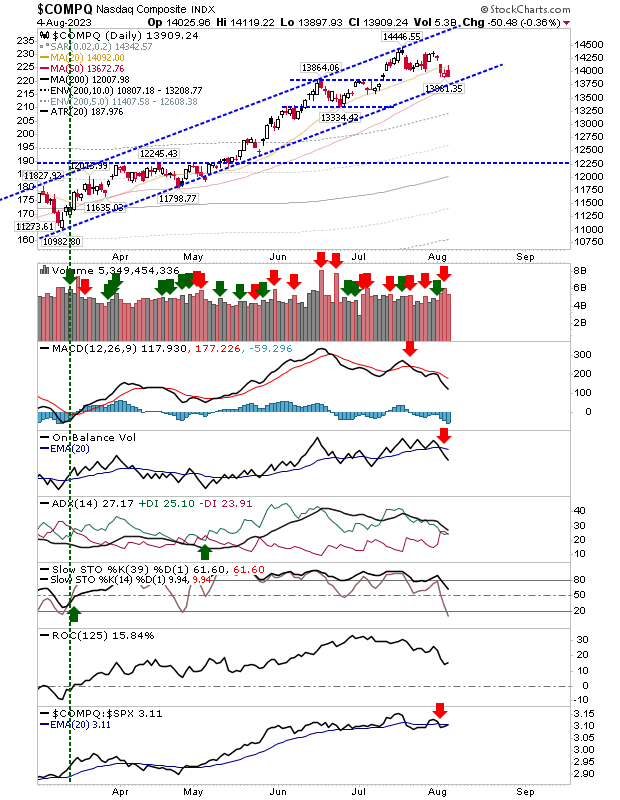

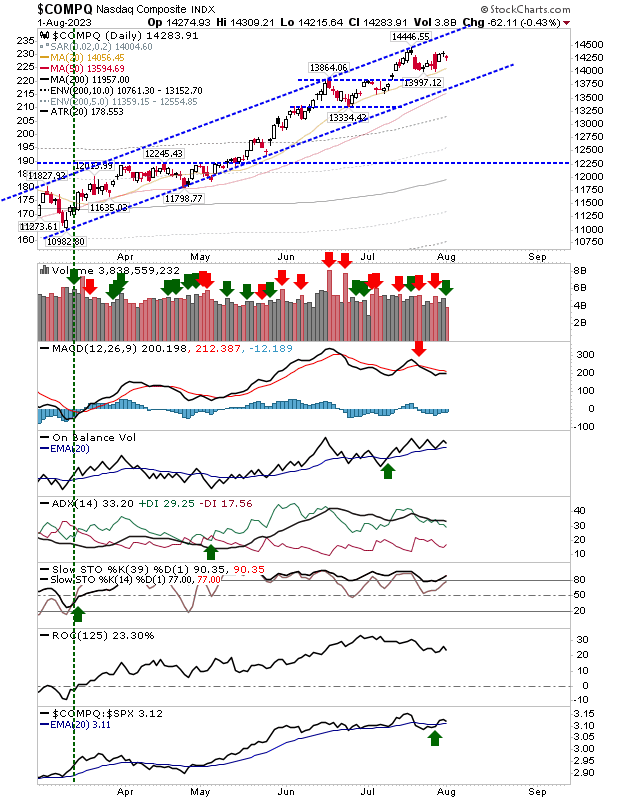

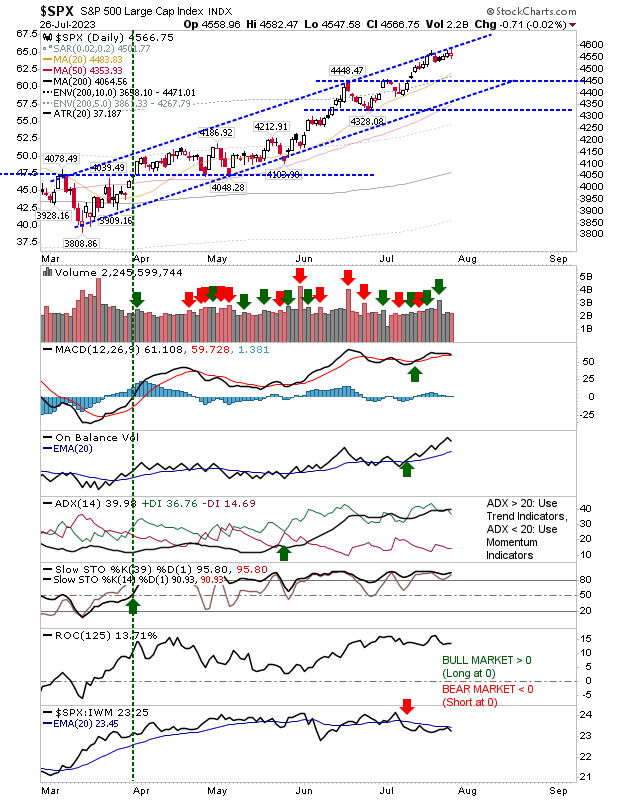

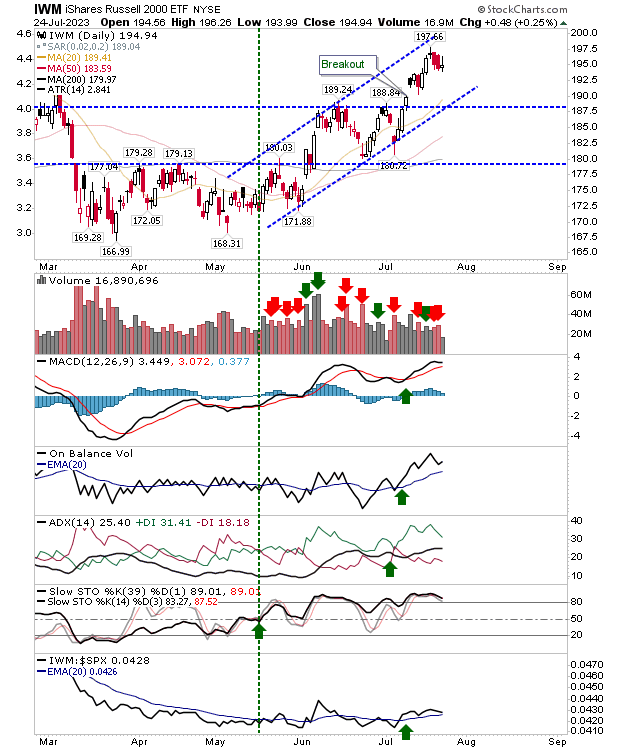

S&P testing price channel support as Semiconductors struggle

Market weakness continued to strike market, but selling volume remained light. The Nasdaq moved further away from support, all but confirming the channel break, but aslo dropping below its 50-day MA. Technicals are net negative, but intermediate-lenght stochastics have some way to go before becoming oversold. While the losses are quite orderly, the could continue for a number of days, if not weeks.