Vacation trading in full swing as markets drift along.

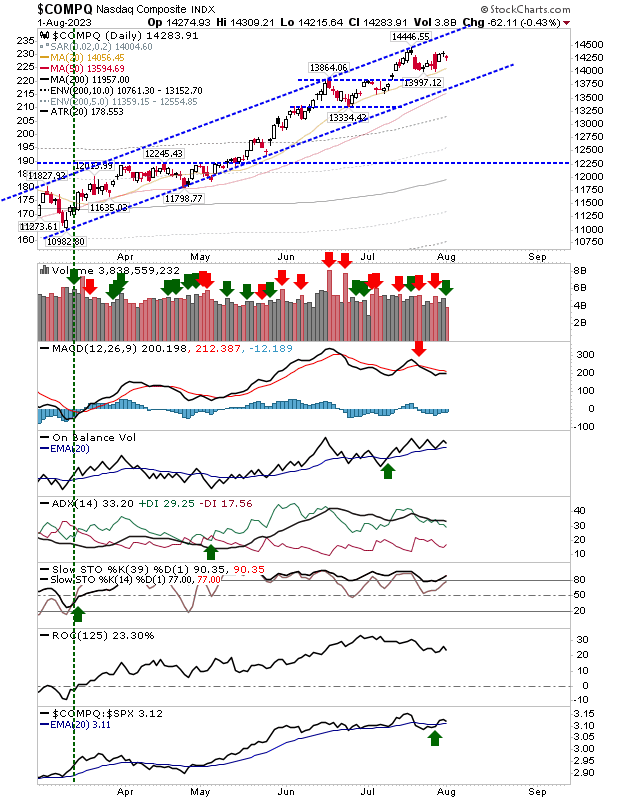

Looks like I haven't missed much since I have been away. The Nasdaq pitched sideways after tagging channel resistance. There was no change in the supporting technical picture.

The S&P is running along channel resistance, drifting a little to the point of a weak MACD 'sell' trigger. However, the trend in On-Balance-Volume is nicely bullish.

The Russell 2000 ($IWM) is trading in the middle of its rising channel, not doing a whole lot. If there is anything to focus on, selling of the past few days has skewed in favor of distribution, but price action hasn't broken.

There is not a whole lot to add to this. The prior trend is bullish and until we see some clear price + volume action to change this, then assume rallies will continue.

Get a 50% discount on my Roth IRA with a 14-day free trial. Use coupon code fallondpicks at Get My Trades to get the discount.

---

Investments are held in a pension fund on a buy-and-hold strategy.